Large NFT dump traded on BLUR

According to Andrew Thurman, a psychometric enhancement technician with Nansen, it has been the ‘largest NFT dump ever’.

On a thread in Twitter he mentions 90 Bored Ape Yacht Club [BAYC] NFTs, 191 Mutant Ape Yacht Club [MAYC] NFTs, and 308 Otherdeed NFTs. Floor prices of BAYC, MAYC and Otherdeed NFTs have seen their initial prices drop 7.77 percent, 9.2 percent and 8.16 percent in the past 24 hours, according to data from NFT Price Floor. Thurman went on to speculate that it could be a result of market manipulation when Machi Big Brother quickly bought back 991 NFTs soon after they were sold.

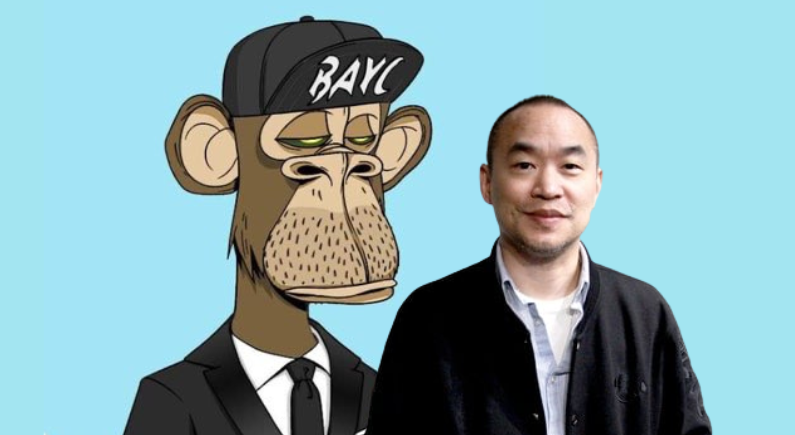

Machi Big Brother

Investor and entrepreneur Jeffrey Huang, aka Machi Big Brother, is a former music recording artist. He evolved into the technology industry with a focus on entertainment and esports. He is founder of C.R.E.A.M. Finance and Machi Xcelsior Studios.

Blur is top-ranked NFT platform

BLUR token has a market cap of US $466 million with tokens at the current price of US $1.20 each. Traders are making use of Blur as a buy and sell NFT platform. However, the surge in trading volume at Blur is not only a result that is driven by traders selling off BLUR tokens and holding on to high value NFTs. It is also the impact of whale traders trading NFTs at an increased frequency in an effort to boost token reward allocations.

Machi is said to be one of the biggest recipients of the Blur [BLUR] token AirDrop from the NFT marketplace Blur, which recently surpassed OpenSea as the top-ranked NFT platform in terms of trading volume.

Digital art traded by Machi include 90 Bored Ape Yacht Club (BAYC) NFTs for 5707 ETH, 191 NFTs from the Mutant Ape Yacht (MAYC) collection for 3091 ETH, 112 Azuki for 1644 ETH and 308 Otherdeed for 582 ETH, among hundreds of other NFTs. The sales of these digital artworks netted the NFT whale more than $17.8 million.

NFT trading

Users on Twitter have raised concerns about the liquidation of NFTs mortgaged on NFT liquidity protocol BendDAO, due to the fall in NFT prices from Machi’s massive sale. Thurman also speculates on whether the NFT trading is just a way to ramp up activity.

Related articles:

NFT tokens will preserve Titanic legacy