Tech Talk: Joshua Ellul on the future of Cryptocurrency after Venezuela’s mining ban

In light of the recent news that Venezuela has shut down several cryptocurrency mining operations across the nation, AIBC News reached out to expert Joshua Ellul for an interview. The focus was on the potential implications of this move from Venezuela and its potential impact on the cryptocurrency market in Latin America.

Joshua Ellul is an Associate Professor and Director of the Centre for Distributed Ledger Technologies. He is an expert in Blockchain, Distributed Ledger Technologies (DLTs), smart contracts, and the intersections between technology regulation and law.

Ellul also leads a multidisciplinary Master’s program in Blockchain and DLT that attracts students from various backgrounds such as ICT, law, business, finance, economics, management, accounting, and entrepreneurship.

Read the full interview below

Anonymity has been linked to Bitcoin and Crypto Technologies in general. Is there any correlation between this anonymity and criminal activities, such as those alluded to in the context of the Venezuelan ban?

I can only speculate with regards to the reason why mining operations have been halted in the mentioned LATAM states.

Bitcoin, alongside any cryptocurrencies that use Proof-of-Work mining, are the only cryptocurrencies that provide a way of getting anonymous crypto. Like physical gold mining, a bitcoin miner can ‘find’ bitcoin. No one would know who they are – and this is not a bad thing.

We often associate anonymity with bad actors, but there is nothing associated with mining that is illegal – a miner undertakes work and is rewarded for their work. We should rather think about it in terms of privacy, more than anonymity.

This typically raises discussions regarding cryptocurrencies being associated with criminal activity. But really the argument is not about cryptocurrency but illegal activity itself.

In your opinion, how do illicit activities involving cryptocurrencies compare to those involving traditional fiat currencies?

Illicit activity operates with all types of fiat currencies, banks, commodities, property, and all types of goods and services. The big difference is that crypto transactions leave a tamperproof public record – which enforcement agencies and investigators can then use to find illegal actors in future.

You can find countless instances of where illegal activity is being caught due to this. The question then should be whether the AML/PFT and KYC regulation and processes that have been put in place are actually finding and minimising crime.

In fact many reports show that, first, the use of cryptocurrency can help identify illicit activity. Second, that the percentage of illicit activity in cryptocurrency is very small compared to that of traditional fiat currency.

Alongside potential criminal activity concerns, concerns on energy consumption orbited the recent mining ban. What is your perspective on the energy consumption concerns surrounding cryptocurrency mining? Does it compare to other energy-intensive technologies?

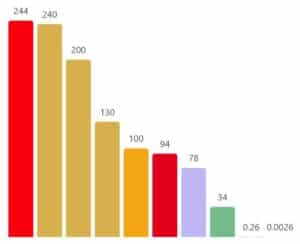

Whilst mining is often reported as the innovation that will be the end of the world – due to its allegedly over-the-top energy requirements, the argument needs to be put into perspective. In reference to a graph I shared with you earlier, demonstrating energy costs of various activities:

- first red column is YouTube;

- in gold: gold mining, data centres, and another gold mining operation;

- yellow: bitcoin mining;

- next red: Netflix;

- blue: Ethereum old proof-of-work;

- green: Gaming in the US;

- 0.26: paypal;

- 0.0026: Ethereum’s new proof-of-stake network

By analysing the graph, you will find that when compared to Youtube, Netflix and Gaming, bitcoin appears to be the most sustainable source of energy consumption. Clearly, YouTube requires much more energy. Should we ban it or stop it? I don’t think so. It’s useful.

It is not just about YouTube or any other specific source of energy consumption per se. Many other systems and technologies will consume a lot of energy. AI training takes a lot of energy, for instance. The point is that the question we should be asking is, in fact: Is the utility worth the energy overhead? We should ask this for every technology.

It’s great that you have mentioned gold mining, as bitcoin is often cited to be a commodity. Do you see it as a viable alternative to gold and other commodities, in terms of energy consumption?

It can be argued that it is indeed a viable digital alternative. When owning gold in a bank, exchange or other service, you are trusting that institution with your gold.

Here we are comparing assets that one can have in their direct possession, such as physical gold or bitcoin. Bitcoin provides a digital alternative to this with some differences. But if it could be an alternative, then the energy cost is comparable.

However, we do need to consider whether the mining costs are comparable once all bitcoin is found. In the case of gold, we could just stop mining which would not incur mining overheads. At the same time, transporting and selling gold has real-world transportation costs.

How does the energy consumption of cryptocurrencies as payment methods compare to traditional payment methods in terms of environmental impact and sustainability?

Let’s compare PayPal and bitcoin, for instance. When it comes to energy consumption, PayPal has much lower overheads than bitcoin. Additionally, bitcoin’s transaction time makes it unsuitable for real-time payments.

However, there are layer-2 protocols that can provide solutions to this problem and do not require high energy costs. Thus, we can view bitcoin as a viable alternative to gold, and layer-2 solutions like the Lightning Network as an alternative to centralised payment systems like PayPal.

Often, people assume that all blockchains are energy-hungry networks. However, this is not always the case. For example, Ethereum’s Proof of Stake (PoS) energy consumption is lower than PayPal’s energy consumption.

In light of everything we have discussed, what do you see as the potential benefits and drawbacks of widespread adoption of Bitcoin as a replacement for various day-to-day services, such as the current banking system?

Many people believe that Bitcoin has the potential to replace parts of the banking system. Given the financial crisis that occurred in 2008/2009 and the ones we are currently experiencing, it’s worth considering whether Bitcoin can serve as a viable alternative.

Fractional reserve banking can work until it fails. However, centralised entities can still play important roles in the financial system. If Bitcoin can prevent such collapses and reduce the risks of people losing their investments, jobs, and taxpayers bailing out financial entities, then it’s worth exploring the extent to which this can be achieved.

If we were to consider the overall energy consumption of the banking system, including factors such as people commuting to work, logistics, and IT systems, I believe it would require a significantly higher amount of energy compared to Bitcoin. Although the banking system has frequently resulted in catastrophes, as we have seen in the past two decades – 2 failures in less than 2 decades is too frequent an occurrence – Bitcoin continues to operate according to its protocol without fail.

And, to go full circle and make another point on corruption, it appears that the more humans are involved in a process, the more likely we are to see corruption. Blockchain technology can offer solutions to this problem, but it’s important to note that we shouldn’t aim to completely remove human intervention. Instead, we should consider minimising human intervention only when it is required, necessary, possible, and feasible.

AIBC to pioneer new ventures in São Paulo

Join us this June in São Paulo, Brazil for the AIBC Americas Summit and get the chance to learn from industry experts and thought leaders. Don’t miss out on this opportunity to connect with like-minded professionals and discover the latest trends and innovations that are shaping the future of the crypto industry in the Americas.

Check out our website for more information and updates on LATAM, or engage with some thought-provoking podcasting below!