Bank of England responds with an increase in interest rates

As a result of the rising inflation, the Bank of England increased its benchmark interest rate today to 4.5 percent. This is the seventh rise since May 2022 when the base rate was at a record low of just 1 percent. The increase today makes it the highest level since 2008.

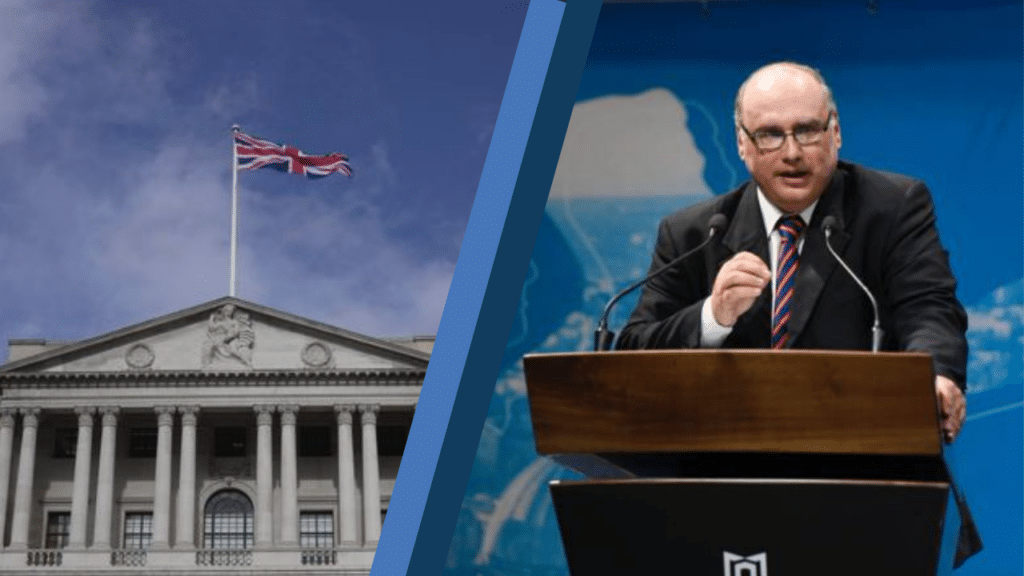

Professor Philip von Brockdorff, Governor of the Malta Financial Services Authority (MFSA), spoke with AIBC News about the increase in interest rates by the Bank of England today.

The increase of 0.25 percent in the interest rate announced by the Bank of England is a response to the inflation rate prevailing in the UK with food prices now accounting for a significant proportion of overall prices increases,” Professor Philip von Brockdorff, Governor – Malta Financial Services Authority

In a statement the Bank of England explained that the strength of the labour market meant that higher borrowing costs were were necessary to curb the rate of inflation.

The European Central Bank also increased its benchmark rate to 3.25 percent in early May and is now nearing a high not seen since 2001. A few days before, the US Federal Reserve increased its rate from 5 percent to 5.25 percent, the highest level since mid-2007 and its 10th consecutive increase in just over a year. Both The Bank of England and the ECB are approaching the end of their rate-tightening cycles as price pressures fall from a peak. A global credit crisis is expected.

Professor von Brockdorff explains that as in the case of the euro area, the decision by the Bank of England reflects the dominant thinking that the only way to reduce inflation is through monetary policy of interest rate adjustment. This is expected to work but only at the cost to borrowers for businesses and buying property. This added cost could slow down economic growth or further delay economic recovery depending on the stage of the economic cycle.

The problem lies if the current inflation rate persists, he adds. This can be ruled out given global uncertainties and a return to restrictive trade practices as well as pressures on the part of trade unions to raise wages for members because of the secondary round effects and the higher cost of living.

Professor Philip von Brockdorff is Governor of the Malta Financial Services Authority (MFSA). He is head of the Department of Economics at the University of Malta. He is a member of the European Economic and Social Committee (EESC) and serves as rapporteur for a number of important dossiers requested by the European Commission. Previously Professor von Brockdorff served as Permanent Secretary for economic growth for seven years. His area of expertise is demographic economics with a focus on policy analysis and the role of the euro in international markets.

Related content:

AIBC Geopolitical Analysis: Historic free trade deal

European Central Bank is tinkering with the idea of digital currency

JP Morgan Chase absorbs First Republic Bank