Will the EU ban Bitcoin in the future?

Bitcoin is under attack. Elon Musk’s Tesla stopped accepting BTC in 2021. Wikipedia halted Bitcoin donations after 8 years and Greenpeace and other organisations have also stopped accepting Bitcoin for their products or as a means to donate money. But these minor infractions are nothing compared to Europe’s ongoing crusade against Bitcoin mining.

In 2021, the richest man on the planet said: “Cryptocurrency is a good idea on many levels, and we believe it has a promising future, but this cannot come at great cost to the environment.”

Musk wasn’t alone in having such concerns about mining. Politicians and policy-makers have also taken aim at Bitcoin, particularly those in Europe.

Before the European Commission’s ‘Markets in Crypto-Asset Regulation’ (MiCA) regulation was ratified, it caused a controversy within the bitcoin community. Certain factions in the European parliament that are opposed to proof-of-work (PoW) mining cited energy concerns underpinning their reasoning.

This abrasive approach laid the foundations for restricting cryptocurrencies, mostly used by tech startups trying to raise money. Set to come into force in 2025, the MiCA bill will oblige crypto projects to disclose the ‘carbon footprint’ associated with an asset. In turn, brokers and exchanges must inform customers about these figures when purchasing an asset.

The distaste for Bitcoin is not restricted to the EU. In the US, an anti-Bitcoin Greenpeace campaign took off in March last year. The campaign was financed by Ripple co-founder Chris Larsen, among others.

Notably, Greenpeace accepted bitcoin donations between 2014 and 2021, until they were put on hold due to now-debunked environmental concerns about PoW mining.

In reality, the common thread across these attacks appears to be more about competition than anything else, but we’ll get to that later.

Nearly half of EU policy-makers do not like Bitcoin

While a mining or trading ban did not make it into the MiCA legislation, there is a concerted effort by Euro parliamentarians to crack down on Bitcoin, in similar fashion to how China (unsuccessfully) banned Bitcoin mining in early 2021.

In April 2022, some European Parliamentarians tried to ban bitcoin mining and trading all at once. The following month, the economic and monetary affairs committee (ECON) voted against the ban. Thirty-two members were against, and 24 in favour.

Over the years, ‘proof-of-work’ has become a divisive ideological line, far removed from its exceptionally ordinary environmental impact. One can loosely define the political divide as Social Democrats and Greens in favour of a ban, versus Conservatives and Liberals, who tend to vote against.

Thankfully, a compromise was reached by conservative MEP Stefan Berger, who settled for a rating system for cryptocurrency assets regarding their so-called environmental impact. But underneath the surface, it’s clear that trouble is still brewing in Europe.

In an email exchange with Politico, Spanish parliament member Ernest Urtasun explained: “Creating an EU labelling system for crypto will not solve the problem as long as crypto-mining can continue outside the Union, also driven by EU demand… The Commission should rather focus on developing minimum sustainability standards with a clear timeline to comply.”

He added: “Ethereum’s recent upgrade just showed that phasing out from environmentally harmful protocols is actually feasible, without causing any disruption to the network.”

Axis Unite against BTC?

The European Central Bank (ECB) is not too keen on Bitcoin adoption either. In fact, the ECB frequently issues unsubstantiated warnings about the cryptocurrency’s “exorbitant carbon footprint” as “grounds for concern”.

On November 30, 2022, an ECB blog post titled “Bitcoin’s Last Stand”, was filled with inaccurate statements and juxtaposed criticisms with no supporting evidence or data, as covered on AIBC. In it, the ECB’s Market Infrastructure And Payments Director General, Ulrich Bindseil and advisor Jürgen Schaff argued, among other things, that, “Bitcoin’s conceptual design and technological shortcomings make it questionable as a means of payment.”

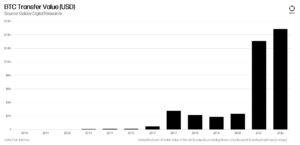

The authors ended their paradoxical verbal salad by saying that Bitcoin is on a “road to irrelevance,” despite network growth showing the complete opposite, per 2022 data from Galaxy Digital Research.

The Union’s pointlessly harsh stance against bitcoin tends to come in waves. In July 2022, the ECB singled out Bitcoin in a research article, comparing proof-of-work to fossil fuel cars, while comparing proof-of-stake to electric vehicles. Ignoring the fact that this comparison makes no sense because of the high energy costs involved in making Lithium-iron batteries, the statement itself shows that Europe has an axe to grind against proof-of-work.

It reads: “it is difficult to see how authorities could opt to ban petrol cars over a transition period but turn a blind eye to bitcoin-type assets built on PoW technology, with country-sized energy consumption footprints and yearly carbon emissions that currently negate most euro area countries’ past and target GHG saving. This holds especially given that an alternative, less energy-intensive blockchain technology exists.”

In other words, the ECB believes it is unlikely that the EU won’t take action on PoW-assets in terms of CO2 emissions. The authors argue that the EU will probably take similar steps on phasing out PoW, as they intend to do with fossil fuel cars. According to their erroneous understanding, PoS is an “alternative, less energy-intensive” technology.

A conflict of interest?

But could it be that a fundamental conflict of interest is driving the ECB’s arguments, and not a concern for the environment, given the lacklustre evidence for such concerns?

Most citizens in Europe conceptualise money as something that it is not. We perceive money as having value because the appropriate body (the ECB) declares it so (hence the term fiat money – money by decree). In fact, long-term value comes from the intrinsic properties of an asset.

Much like the US Dollar, the Euro is subject to constant changes, which has resulted in double-digit inflation. As Euros are printed, purchasing power decreases and this trend only goes one way, else the entire system collapses due to a global sovereign debt crisis.

For the average citizen, the question is: how much will 100 euros buy a year or five years from now? The ECB controls the Euro’s properties by decree. This necessarily decreases purchasing power over time, making it less attractive to hold. On the other hand, Bitcoin’s properties are static and public, increasing purchasing power over time.

As such, it would appear that central bankers have more reason to be concerned about losing control of the money supply than about PoW’s miniscule environmental impact. This explains the ongoing crusade against proof-of-work in parliament.

Europe’s PoW energy debate

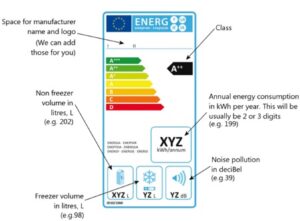

Come 2025, Europe will have introduced a carbon ratings system. Instead of focusing on increasing energy supplies to improve living standards, Europe is choosing to limit energy consumption, thereby reducing living standards. Energy labels for fridges, televisions and other appliances will become common place in the EU.

As such, one can already expect Bitcoin will get the worst classification of all, in congruence with Euro-parliamentarians anti-Bitcoin stance. In other words, this is positive for proof-of-stake coins like Ethereum, but negative for proof-of-work coins like Bitcoin (in the EU).

This prospect depends on whether convenient narratives or hard facts win out. If the current misinformation about Bitcoin’s energy usage prevails, it’s possible that such labelling will scare off users and investors from purchasing Bitcoin.

By all respectable measures, Bitcoin’s energy usage is effectively a ‘rounding error’ as far as global energy is concerned. Recent research on Bitcoin’s estimated energy consumption by 2040 indicates consumption is somewhat dependent on Bitcoin’s Dollar price. But evaluations are “still far below the doomsday estimates provided by certain Bitcoin critics.”

A recent quarterly report from the Bitcoin Mining Council also found that as of the first quarter of 2022, the mining industry’s sustainable electricity mix had a 59% year-on-year increase from, Q1 2021 to Q1 2022, making it one of the most sustainable industries globally.

The question is: will Euro-parliamentarians and ECB executives listen to the data, or will they continue their baseless attacks against proof-of-work mining?

Confounding information

The bourgeoise consensus seems to point towards something like “retire the ‘outdated’ PoW consensus mechanism in favour of a ‘new’ PoS standard”. Without proper pushback, this demonstrably flawed logic is set to become more prevalent since Ethereum’s successful merge.

Meanwhile, bystanders, through no fault of their own, are unaware of the critical trade-offs Ethereum made to achieve this engineering feat. After the merge, Ethereum completed its transition to becoming an extension of the fiat monetary regime, complete with a defacto central bank (the Ethereum foundation) and rich stakeholders, who have already changed the protocol’s supply issuance.

Ontologically, Bitcoin is derived from inherent characteristics introduced by Satoshi Nakamoto at the height of the great financial crisis. Regulators are struggling to accept this revolutionary monetary technology as they have never faced competition from public money. But for those policy makers who truly serve the public good, then proof-of-work is an innovation to embrace, not one to fear, ban or resist.