First Republic Bank in crisis – another casualty for US banking

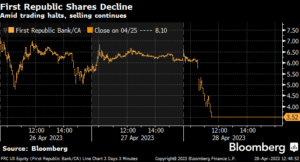

San Francisco-headquartered First Republic Bank fell to a historic low as trading was suspended amidst talk of a takeover. By close of trade this week, First Republic shares had crashed 43 percent. Yet another US banking casualty which saw a decline in value over of US $21 billion for the bank.

The bank took out loans from the Federal Reserve and the Federal Home Loan Bank and set up a credit line led by JP Morgan Chase and a consortium of 11 major US banks. Bloomberg reported that deposits of up to US $30 billion were made to boost First Republic Bank with fresh capital – a case of throwing good money after bad. The cash injection was not substantial enough to restore the bank to sustainability.

In a statement this week, the bank said that it is in “discussions with multiple parties” about a strategic takeover. It is reported that JP Morgan and Pennsylvania-based PNC Bank are bidding to buy First Republic Bank before Monday.

Still recovering from last month’s banking collapse

Once First Republic Bank released its Q4 results, stock began to fall and around US $100 billion in deposits were lost. First Republic’s deposits stood at US $173 billion when Silicon Valley Bank collapsed and just after a month, on 21 April, the bank’s deposits have dropped to US $102.7 billion.

Further instability is on the way in the US banking sector. It has still not quite recovered from the collapse of the two regional lenders, Silicon Valley Bank (SVB) and Signature Bank (SB) last month. According to regulators, the failure of the two banks was a result of poor management.

Around that time, S&P and Fitch downgraded First Republic citing the “high proportion of uninsured deposits” as potential problem. It is expected that First Republic Bank will most certainly be removed from S&P 500.

Second largest bank to fail in US history

Trading in First Republic shares was halted on Friday after its stock plummeted by 50 percent. This had a domino effect with the regional lender’s stocks then crashing further after markets closed. Its shares were halted at US $3.09. The price recovered slightly to US $3.51 when trading reopened, only to crash again after the market closed. This time around the shares tumbled by another 49 percent to US $1.77. That price, if it holds until the opening on Monday, would put shares down by more than 98 percent this year.

Every time First Republic shares start trading again, they just take another leg down and get halted. It’s becoming painful to watch. It’s down 50 percent now.” Nick Glinsman – Macro Hedge Fund Strategist (said on Friday)

First Republic Bank has a workforce of 7,000 and is the second largest bank to fail in US banking history.

Looking forward, high rates are expected to continue on employment and corporate earnings. This will see a downturn in the stock markets. Although equities have only shown around a 4 percent decline in corporate earnings, the economic environment for 2023 appears bleak.

Rise of macroeconomic environment

The repercussions of an emerging macroeconomic environment have hit the US banks. The heavy investment in the bond market made an impact on the bank’s profits when interest rates started to rise. A number of smallish tech companies wanted access to their deposits. In addition the banks were unable to curb the huge losses in the bond market portfolio and this brought on a predicted bank run.

Major banks in the US are very tightly regulated. They are required to have reserves of securities and cash to avoid a repeat of the 2008 global banking crisis. Therefore the FDIC, Treasury Department and Federal Reserve will most probably put up First Republic Bank for auction as an entity. Another option is that First Republic may be sold in separate parts. This means that taxpayers will be let off the hook, although it may be very temporary measure.

However quite a large number of regional banks are not included in this regulation. This means that they may have been poorly managed and are at a risk of bank run. In turn, this will escalate problems that the banks may be facing.

Inverted yield curves predict recession

The bond market’s recent performance has been a clear sign of the forthcoming downturn in US banking. Analysts are forecasting a great recession. The inverted treasury yield curves also indicate that a recession is on the horizon – the yield curves during the previous recessions of 1990, 2001 and 2008 were very similar.

Strategists say that previous recessions kicked off six months after the yield curve inversion which means that the recession this time should begin in May as the inverted bond yields appeared in November last year. The 2-10 year inverted yield curve was at its steepest in over 40 years on this occasion.

Related content:

Theranos founder appeals against prison sentence

Smart City technology project announced for Manila

Abu Dhabi Securities Exchange welcomes first listing from UAE

Stop Press ! Find out more about AIBC Asia Summit