Australia Reserve Bank reveals use-cases for pilot CBDC

The Reserve Bank of Australia published a report detailing a usage proposal for respective providers which will explore the potential use-case of a central bank digital currency (CBDC).

Governments worldwide have been openly criticised for pursuing the technology due to the ability to reduce the scope of money and legal tender to a coupon code that can be programmed.

Regardless, Australia now joins a long list of countries that are looking to build their own currency, and ultimately integrate it with tomorrow’s financial rails, currently embodied in the catch-all ‘cryptocurrency’ sector.

In a press release, the RBA stated:

“Today we are announcing the use case proposals, along with their providers, which have been invited to participate in the live pilot, which will take place over the coming months.”

The research project launched in September 2022 as a joint collaboration effort between the RBA and the Digital Finance Cooperative Research Centre (DFCRC), with the stated intention of demonstrating eAUD capabilities in terms of costs, speed, and outcome quality.

However, the stated intentions and the underlying realities are at odds with one another. On the one hand, costs could be reduced, but on the other, CBDCs provide currency operators direct access to consumers, wherein spending limits and other parameters such as goods consumption limits can be programmed at will.

The question is: will the average consumer benefit from a would-be downgrade in the monetary properties enjoyed via cash and to a lesser extent debt-based money?

Supposed CBDC use-cases

The report is a follow-up to the September launch, which called on industry participants to add proposals for possible applications of eAUD which the RBA could review and select.

The RBA wrote: “The project received a large number of use case submissions from a range of industry participants. A range of criteria was considered in selecting the use cases to participate in the pilot, including the potential to provide insights into the possible benefits of a CBDC.”

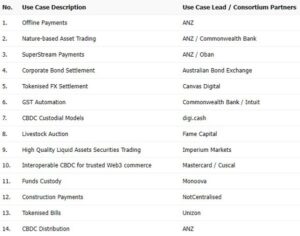

In total, the central bank chose 14 use cases, including offline payments, tokenised foreign exchange settlements, construction payments, and corporate bond settlements. Providers chosen to deliver the pilot use cases ranged from fintech firms like digi.cash to behemoth financial institutions such as ANZ and Mastercard.

Use cases and providers. Source: RBA

The Assistant Governor at the RBA, Brad Jones welcomed the research project, saying that “it has been encouraging that the use case providers that have been invited to participate in the pilot span a wide range of entities in the Australian financial system, from smaller fintechs to large financial institutions.”

According to the central bank spokesperson, the pilot project idea should enhance policymakers’ understanding of how a CBDC could operate, and potentially benefit the Australian financial system. The question as to whether this project will be beneficial for all, not a select few politically connected financiers is wide open, however.

According to CBDC Program Director, Dilip Rao, the process will serve as a means to validate use cases for “industry participants and regulators” to further understand “design considerations for a CBDC that could potentially play a role in a tokenized economy.”

Countries hasten CBDC development

Australia forms part of over 114 countries that are currently testing central bank digital currencies, with the full intention to eventually deploy them. Japan is expected to launch its digital yen pilot program beginning in April, which also happens to be the start date for Russia’s CBDC pilot program. Russia is also looking into using a virtual rouble to settle payments with China and circumvent international sanctions.

Meanwhile, private companies such as Ripple Labs are also working with over 20 central banks in developing CBDCs. These include projects with the sovereign state of Bhutan and the republic of Palau.

Monetary rights

In the United States, privacy concerns regarding the potential development and launch of a CBDC have weighed on policy makers. In fact, a bill called ‘Anti-Surveillance State Act’, was tabled last month in order to restrict the Federal Reserve’s would-be central bank from directly issuing a CBDC to citizens.

The bill states that it seeks to “to amend the Federal Reserve Act to prohibit the Federal reserve banks from offering certain products or services directly to an individual, to prohibit the use of central bank digital currency for monetary policy, and for other purposes.”

Despite the efforts, human and privacy rights advocacy groups are not convinced that central bank operators would be able to resist the temptation of surveillance, and directly accessing citizens’ wallets.

Tensions between central bankers and sound money advocates can only heat up in this push-and-pull battle of attrition over the future of global monetary technology.