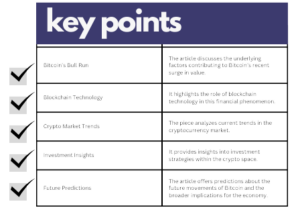

Underlying factors of Bitcoin’s latest bull run

Bitcoin has once again made headlines by reaching a new record value, surpassing its previous peak set in November 2021. On Tuesday, the digital asset soared past the $69,000 mark, although it later retreated to just above $64,000.

The total worth of Bitcoin now stands at approximately $1.3 trillion, representing a significant portion of the overall $2.6 trillion cryptocurrency market.

Factors contributing to Bitcoin’s latest resurgence

Bitcoin was conceived in 2008 by an individual or group using the pseudonym Satoshi Nakamoto. The foundational concept was to create a digital currency that enables direct online payments from one party to another, bypassing financial institutions.

The issue of “double spending,” where a digital token could be duplicated or falsified, is addressed by recording transactions on a universally accessible ledger known as a blockchain. This process is secured by cryptography, with transactions protected by a form of encryption known as public-private key encryption. This allows a transaction to occur without a financial institution mediating it.

Bitcoin transactions are added to the blockchain by “miners” who solve a cryptographic puzzle using specialized hardware. These miners are rewarded with newly minted bitcoins for their efforts.

One of the key appeals of Bitcoin is its anti-authoritarian stance. It offers the ability to conduct financial transactions without a financial institution overseeing the process and levying fees. This has led to its description as “censorship-resistant digital cash.”

Bitcoin has also thrived in a low-interest-rate environment, a trend that has persisted since the 2008 financial crisis. This has driven some investors towards riskier assets like cryptocurrencies in search of better financial returns. Bitcoin has also been viewed as an “inflation hedge,” similar to gold, as it cannot be devalued by a central bank printing more of it due to its finite supply of 21 million units.

However, Carol Alexander, a professor of finance at the University of Sussex business school, argues that it is a mistake to view Bitcoin as a safe haven from market volatility and inflation, similar to gold. She points out that Bitcoin is far too volatile an asset to be considered as such.

A significant factor in Bitcoin’s price increase this year has been the approval of exchange-traded funds (ETFs) that track the price of Bitcoin by the US financial regulator in January. This development indicates a level of “institutional maturity” in the cryptocurrency market, according to Jeff Billingham, the director of strategic initiatives at research firm Chainalysis. He notes that this level of infrastructure and trust was not present in the market during previous cryptocurrency bull runs.

Market volatility and regulatory evolution

Despite the challenges and setbacks, Bitcoin’s appeal remained strong. Its anti-authoritarian stance offered the ability to conduct financial transactions without a financial institution overseeing the process and levying fees. This unique feature led to its description as “censorship-resistant digital cash.”

In a low-interest-rate environment, some investors were driven towards riskier assets like cryptocurrencies in search of better financial returns. Bitcoin was also viewed as an “inflation hedge,” similar to gold, as it cannot be devalued by a central bank printing more of it due to its finite supply of 21 million units.

However, the journey was not without its trials. The collapse of FTX, one of the world’s largest crypto exchanges, and legal issues faced by key figures in the industry, highlighted the instability of the cryptocurrency market. Despite these challenges, the approval of bitcoin ETFs by the US financial regulator contributed to the market’s growth.

The evolving regulatory environment in the UK and EU also played a part in shaping the future of cryptocurrencies. Despite the potential risks, the market’s volatility and high returns continued to attract investors.

As the story of Bitcoin’s resurgence unfolds, one thing is clear – the momentum has to ease at some point. Market moves where prices shoot up dramatically are never sustainable in themselves. However, this doesn’t mean it can’t go higher. Some kind of consolidation or correction seems likely in the interim.

Bitcoin’s resurgence demonstrates the resilience and adaptability of the cryptocurrency market. Despite significant challenges, the evolving regulatory landscape suggests a cautious yet potentially promising future for digital assets. The story of Bitcoin continues to unfold, and the world watches with bated breath

Stop Press – AIBC Africa takes place in Cape Town between 11-13 March !