Investors who started a DCA strategy at $69,000 are up 10%

Bitcoin exchanges hands at around the $28,000 level amidst an ongoing global bank run that has already toppled various major banks. As prices increase, Bitcoin’s worth to investors is becoming more evident even for those who joined after its all-time high.

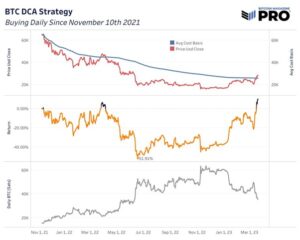

According to data from Bitcoin Magazine shared on March 20, people who started dollar-cost-averaging (DCA) into Bitcoin at its peak price on November 10, 2021 are currently seeing 10% returns on their regular investment, despite the price of Bitcoin being 60% away from $69,000.

Patience pays off?

In 2022, the crypto market didn’t fare so well. In fact, in July 2022 investors recorded a loss of 52%, and a 40% loss in November and December 2022. The situation has since improved significantly for those who stuck to time-tested Dollar-cost-averaging.

The bitcoin dollar-cost average strategy refers to investing a fixed amount of dollars (euros or fiat) at regular time intervals, regardless of the price. Buying $10 or $100 worth of Bitcoin every week would be a normal example of DCAing.

The strategy is often used by long-term investors seeking to buy bitcoin as an insurance policy against braindead or downright sinister central bankers who create financial crises such as the one we’re seeing today.

By averaging in, the strategy allows investors to average into the asset, while minimising the likelihood of allocating substantial sums at peak prices. In essence, volatility is reduced thereby helping people offset mental barriers to entry.

On Sunday, the US Federal Reserve announced a coordinated effort, which introduced US Dollar swap lines (money printing) in an attempt to ensure that depositor money is actually in the banking system. Since the collapse of $200 billion Silicon Valley Bank and Silvergate, central banks have decided to monetise debt to ensure depositor credit.

This has onlookers questioning whether there’s any money at all in the banking system. Consequently, hard assets such as bitcoin and gold are rallying.

Bitcoin has added $220 billion to its market capitalisation in 2023 so far. This has happened against a backdrop of a wide-ranging crisis in the banking sector that led to the five leading banks in the United States to lose an aggregated market cap of $108.92 billion during the same period.

At the time of writing Bitcoin’s total market capitalisation stands at $547 billion.

Disclaimer: this is not financial advice