Digital asset surge amid Republican victory hopes

The digital asset investment scene has been buzzing with excitement lately. Investors are feeling more confident, thanks to political developments in the U.S. that suggest a possible shift in power. With a Republican win looking more likely in the upcoming November election, last week saw the biggest influx of capital into digital asset investment products since July.

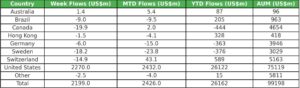

In the past week, digital asset investment products attracted a whopping $2.2 billion in net inflows, marking the largest spike in investments since July 2023. This sudden surge comes as investors brace themselves for the possibility of a more favourable regulatory landscape for cryptocurrencies under a Republican administration.

CoinShares report on digital asset inflows

According to a report from CoinShares, the $2.2 billion in net inflows represents growing confidence among market participants. Investors are positioning themselves for the potential benefits of a regulatory environment that may favour the growth and mainstream adoption of cryptocurrencies.

As election day approaches, trading volumes in the digital asset market have surged by 30 percent. This uptick in activity signals that investors are eager to position themselves ahead of a potential political shift. Market participants are looking for ways to capitalise on a possible Republican victory, anticipating a more open stance on crypto regulation.

Crypto regulation expectations under Republican administration

Polling data suggests that Donald Trump is gaining traction, with a notable lead over Kamala Harris in several key swing states. The connection between political sentiment and the crypto market is clear. A Republican victory is seen by many investors as a pathway to a more supportive regulatory environment for cryptocurrencies.

Bitcoin-based investment products led the charge last week, drawing in an impressive $2.13 billion in inflows. Additionally, short Bitcoin products saw inflows of $12 million, marking the highest level of investment in these products in seven months.

Ethereum (ETH) investment products brought in $58 million in net inflows, while Solana (SOL) products recorded $2.4 million. Litecoin (LTC) and Ripple (XRP) followed suit, attracting $1.7 million and $0.7 million, respectively.

U.S. dominating digital asset investments

The U.S. has emerged as the dominant player in the digital asset investment space, with inflows of $2.3 billion last week. This was largely driven by Bitcoin ETFs, which have attracted significant interest from institutional and retail investors alike. Meanwhile, other regions, including Canada, Sweden, and Switzerland, saw net outflows as investors took profits.

Recent market volatility has only served to increase investor interest in digital assets. As prices fluctuate, many investors see opportunities to buy in at lower prices or capitalise on short-term gains. This has led to a surge in trading activity and increased inflows into digital asset investment products. As the November election approaches, all eyes will be on how political developments influence the regulatory landscape and the future of digital assets.