Bitcoin surges 28% in weeks: new year, new rally?

Bitcoin started 2023 with a bang. The king crypto climbed to $21,300 on Saturday for the first time in two months, and has recorded a 28% increase in 4-weeks to the day.

The most popular crypto is still far away from its record high of $68,990 reached in November 2021. Still, it has given market players cause for relief if not outright optimism. The month-to-date rally follows a terrible performance for 2022, which saw cascading insolvencies and scandals that would make Bernie Madoff blush.

Monetary policy shift?

Investors are eying slowing US inflation data as a potential catalyst for momentum. With inflation data cooling and economic indicators suggesting slowing US activity, the clock might be ticking for the Federal Reserve to soften (if not reverse) its rate hiking strategy.

Last week, new US inflation data showed a modest retreat, with the consumer price index decreasing by 0.1% in December. Setting aside the questionable figure, analysts believe that macro-economic factors could turn the tide for risk assets.

The head of research at digital asset management firm, CoinShares, James Buterfill, said in an exchange with CNBC reporters: “Bitcoin looks to have recoupled with macro data as investors shrug off the FTX collapse.”

“The most important macro data investors are focussing on is the weak services PMI and the trending down of employment and wage data. This coupled with downwards trend in inflation has led to improving confidence, while it comes at a time when valuations for Bitcoin… are close to all-time lows. The prospect of looser monetary policy off the back of weaker macro data and low valuations is what has led this rally.”

The Fed increased borrowing rates at the fastest pace in recorded history in 2022, forcing assets into a downward spiral. In December, the Fed’s benchmark funds rate increased to 4.25%-4.50% – the highest level since 2007.

Bitcoin was caught up in the drama, as fraudulent schemes with lots of bitcoin on their balance sheet were forced to liquidate, adding fuel to the fire. Bitcoin’s fundamental value proposition was in question when FTX blew up and the currency hit a fresh low of $15,400 in November. But according to Blockstream CEO and cryptographer, Adam Back, whose work is referenced in Satoshi’s whitepaper, prices below $20k were ‘nonsense’.

The Fed has said it will keep interest rates elevated for the time being. But some market players are predicting that the Fed could cut rates this year. If the cost of capital decreases, markets tend to react favourably.

Whales buy BTC

Crypto whales don’t seem too worried about the prevailing macro factors. In fact, large buyers of bitcoin known as ‘whales’ could be leading the latest crypto rally.

According to research from Kaiko, trading orders climbed from an average of $700 on Jan. 8 to $1,100 today on the crypto exchange Binance, suggesting renewed confidence in the market by whales.

Large investors who essentially hoard stockpiles of bitcoin are a plenty in the industry. MicroStrategy CEO Michael Saylor, and Silicon Valley investor Tim Draper are among those well-known Bitcoin whales. Other entities include middlemen, exchanges and funds like Barry Silbert’s Grayscale – the largest crypto trust fund in the industry, holding $18 billion in assets-under-management.

The firm has been battling what it calls ‘unjust’ rulings by the SEC, as it seeks to convert its flagship GBTC fund into a spot Bitcoin ETF – potentially solving its financial troubles in the process.

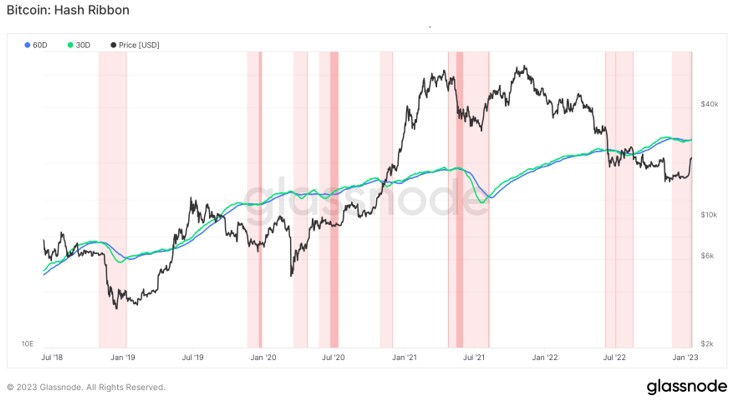

Bitcoin mining difficulty adjusts

The 2022 carnage has also flushed out many bitcoin miners, who over-financialised their operations and ended up declaring bankruptcy in 2022. Bitcoiner miners use ASIC computers in order to verify network transactions, secure the network against bad actors as well as mint new coins.

Historically, ‘miner capitulation’ tends to occur towards the end of a bear market, not at the start of one.

More recently, bitcoin’s network “difficulty” has been on the rise. As miners went offline, the network automatically adjusts the difficulty level in order to maintain the same level of network integrity.

Mining difficulty reached a record 37.6 trillion on Jan 15th, according to bitinfocharts data. This means that it would take an average of 37.6 trillion hashes (guesses) to find a valid bitcoin block and add it to the blockchain.

Before the last update, difficulty fell 3.6%, as miners were forced to shut down their operations. But now, miners are coming back online with more efficient machines following the adjustment, according to analysts at digital asset broker GlobalBlock.

The halving looms

The halving event has nothing to do with price, although you’d be forgiven for thinking that given Bitcoin’s historical volatility.

Today, Bitcoin users and investors are looking at a fundamental network event which happens approximately once every four years. The Bitcoin ‘halving’ is an event where the bitcoin rewards to miners are cut in half. This means the supply of new bitcoins is lower. In conventional markets, lower supply with steady demand usually leads to higher prices.

Halving events usually precede some of Bitcoin’s largest bull runs.

Litecoin – often referred to as the Silver to Bitcoin’s gold, is set to have this event in July 2023. Bitcoin’s halving will take place in April 2024.

Despite the current optimistic picture, the crypto sector is technically still licking its wounds. Bitcoin is down 68% since its all-time-high at the time of writing. But if history is any indication, the top asset will create new highs when central banks are forced to do the only thing they know how to do: print money.