US Fintech Plaid strengthens team with high profile hire as it prepares for IPO

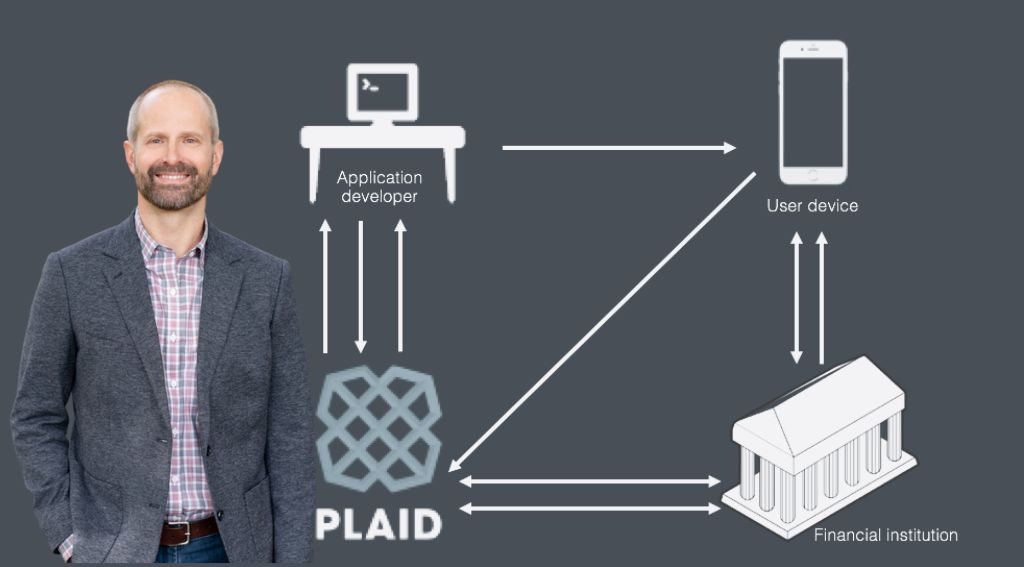

With a potential initial public offering (IPO) seeming more realistic, US-based financial technology start-up Plaid, has appointed its first-ever Chief Financial Officer. This development marks a crucial milestone in Plaid’s journey to going public, following a failed US$5.3 billion merger with Visa two years ago. Eric Hart, (in photo above), formerly the Chief Financial Officer of Expedia, will join this ten-year-old fintech company, a year after departing from the travel industry giant.

Eric Hart’s appointment fills a critical role in Plaid’s preparation for an IPO, a goal set by the co-founder and CEO, Zach Perret, although no specific timeline has been disclosed.

Plaid’s strategic move toward IPO

“Expedia was one of the leading players in that space of the digitization of travel,” Hart said “I see a very similar opportunity here, which is the digitization of financial services. That’s been happening for a while, but I think we can all see that that’s accelerated over the last few years.”

Based in San Francisco, Plaid has been closely watched within the US fintech sector. The company attracted attention following the failed merger with Visa in 2021, when it was valued at US$5.3 billion. Since then, the company has witnessed substantial growth in its business, especially during the COVID-19 pandemic. In 2021, Plaid secured funding in a private round at a valuation exceeding US$13 billion. However, the valuation for many tech companies at that time shifted when the Federal Reserve began to raise interest rates.

Hart’s appointment a milestone in fintech leadership

Plaid’s primary service enables customers to seamlessly link their bank accounts with external applications such as money transfer platforms or online mortgage lenders, allowing them to share necessary financial data. The company’s business has indeed benefited from the increasing adoption of digital banking services, which Plaid plays a pivotal role in facilitating. Among its early customers were popular money transfer app Venmo, and today, it collaborates with industry leaders like Shopify and Google.

Plaid also managed to attract high-profile investors including Silver Lake Partners, Ribbit Capital and the asset management arms of financial giants like JPMorgan Chase, Goldman Sachs, and American Express.

Eric Hart, who, during his tenure at Expedia, was involved in a series of acquisitions, including those of vacation rental service Vrbo and booking site Orbitz, refrained from commenting on specific plans regarding a potential IPO. However, he emphasized the importance of ensuring that the organization, especially from the finance perspective, possesses robust processes, procedures, and compliance. This strategic approach would position Plaid to take a step forward if an IPO becomes the right milestone for the company.

Fintech sector and IPO market over last year

The past year has presented challenges to the US IPO market. Despite this, there have been signs of renewed activity, with notable IPO listings from companies such as German sandal maker Birkenstock, chip designer Arm, and grocery delivery service Instacart. These developments indicate that, despite challenges, there remains significant interest and activity in the IPO market, with potential for positive trends moving forward.

While the last year presented hurdles for the US IPO market, it has shown resilience and adaptability. Despite initial challenges, high-profile IPOs from diverse sectors like fashion (Birkenstock), technology (Arm) and the booming e-commerce grocery delivery sector (Instacart) have indicated that investors are still keen on seizing opportunities in the public market. This is particularly promising for fintech companies like Plaid, that are looking to tap into capital markets for expansion and growth.

With the appointment of Eric Hart as CFO, Plaid is strategically positioning itself for a potential IPO.

Related topics:

Stop Press: AIBC Europe takes place in Malta between 13 – 17 November

Binance exits Russian market selling business to newcomer (aibc.world)

AIBC Forex: Bank of Japan’s bond buying spree