Silicon Valley Bank collapse and the great reset

Silicon Valley Bank (SVB) was seized by regulators this week as the $209 billion bank became insolvent, practically overnight. But what happened, and where might persistent traditional banking failures lead?

Under ‘fractional reserve banking’ rules, banks are required to hold 5%-10% of deposits on hand, while being allowed to lend out the rest to make money. Most people forget that banks are not there for clients – they are a business like any other. In 2020, the reserve requirement was reduced to 0% for certain institutions in order to create more capital flows which should trickle down to the economy.

In 2020 and 2021, SVB was encouraged by the US government to buy 10-year mortgage-backed securities, which yield 1.5-1.8%. In theory, these securities are not risky, meaning the bank could push the leverage ratios.

SVB’s error is that the securities had maturity period of 10 years as opposed to shorter-dated maturity treasuries or mortgage bonds period of less than 5 years. Consequently, there was a mismatch between on-hand assets and liabilities.

The bank could have hedged its risk, but it didn’t.

In 2022, when interest rates surged and the bond market fell (since bonds move opposite to yields), and SVB’s portfolio suffered major losses. The bank had $211 billion assets by the end of 2022, with $117 billion invested in securities. These bonds incurred substantial losses by year-end, with $91 billion of the portfolio classified as ‘held-to-maturity’ now worth $76 billion – a massive haircut.

These securities faced 20%-30% in paper losses, and accounting rules forced the bank to report them at the maturity value. Analysts caught on, Peter Thiel advised investors to pull their money, and investment dollars slowed, creating an increasing need for capital. Consequently, SVB prematurely sold some securities and a hole in the balance sheet appeared, with ‘realised’ losses growing as bank failure gossip spread throughout the financial world.

This is what a feedback loop looks like. From this point there was no going back.

USDC De-pegging

Many worried that crypto failures would increase again due to tradfi – but that wasn’t exactly how it played out.

The second-biggest US dollar-pegged stablecoin, USDC, lost its peg and dropped below 87 cents on Saturday. The issuer, Circle, announced that it had $3.3 billion held with SVB (the insolvent bank), which created a hole of 5% in its balance sheet. As the information spread, investors swapped to Tether (USDT), the largest stablecoin to date.

The de-pegging event for USDC hit the US-regulated business Circle, which was founded by Coinbase. At the same time, the event was a clear wake-up call to all industry participants, demonstrating that ‘not your keys, not your coins’ applies to individuals, banks, and centralised entities. Circle then announced it would use corporate resources to cover any shortfalls, which resulted in a re-pegging and a market rebound.

USDC currently trades at $0.99 cents.

Regulators step in

The big topic of conversation after this liquidity crunch is whether we should trust centralised institutions.

The panic continued over the weekend and into the week, with venture capital firms, startups and investors realising that FDIC insurance only protects the first $250,000 of their money in a bank. Many customers started lining up at outlets across the country to withdraw funds and transfer them to one of the ‘big 4’ US banks, i.e. JP Morgan Chase, Bank of America, Wells Fargo, and Citibank.

Suddenly, depositors asked the question: why is only $250,000 guaranteed? Where’s the rest?

While this is plenty of money, small-to-medium sized businesses might have capital split across multiple accounts. And indeed, why aren’t bank deposits 100% guaranteed? A checking account in the United States or in Europe is not considered to be high-risk, and yet it certainly appears to be.

Pressure mounted and the US Federal Reserve issued a press release together with the Treasure and FDIC, announcing it will back-stop deposits. This is money printing through the back door instead of through the front door. The action was applauded, but the consequence is that inflation could come back roaring before the Fed reaches its 2% target.

The last reading was 6% year-on-year.

This means the Federal Reserve is more worried about traditional banking solvency than it is about inflation. The central bank will “address any liquidity pressures that may arise.”

What does this mean for the crypto sector?

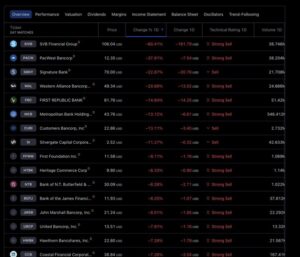

Banks are collapsing left right and centre, be it Signature Bank – now taken over by regulators – Silvergate or Silicon Valley Bank. The contagion effect has also spread to Europe. Credit Suisse – the 7th largest bank on earth is probably insolvent as I write this. It’s rumoured that First Republic Bank will also be taken over by regulators.

The key shutdown of platforms like the Silvergate Exchange Network (SEN) and Signature Signet pose a problem for a segment of the crypto sector. Both platforms facilitated payments for commercial clients via 24/7 instant settlement services.

Losing both platforms could impair liquidity conditions until new non-US banks step in. Many have speculated that this is a coordinated effort by regulators to ‘choke out’ the crypto sector in a bid to kill off competition – in particular stablecoins.

So far, the US crypto crackdown has strengthened the top stablecoin issuer – Tether.

The Great Reset

Bitcoin was made for this exact situation, according to bitcoiners who came out strong on the matter. The great reset is a concept which is thrown around a lot, but bitcoiners have co-opted the menacing term to advocate for users to stop trusting centralised institutions with things that matter to them.

After all, these institutions are run by fallible human beings who make decisions and mistakes on user’s behalf – often without suffering much of any consequence at all (besides filing a bankruptcy report).

Bitcoin is decentralised stored value, and there isn’t a central figurehead which can create more bitcoin if it runs into liquidity issues. There is no ‘run on the bank’ with self-custody, and nobody is taking financial decisions with your hard earned money by buying volatile bonds.

Decentralisation goes beyond the scope of money, however. It’s an ethos that advises on how to run our communities, resource management, and decide what government can and cannot do. As more people come to this realisation due to incumbent failures, the choice to opt out of the traditional system will become obvious.

The great reset is coming. Bitcoin and Litecoin will be the currencies of choice.