Forex implications of the UAE Egypt Ras al-Hikma development project

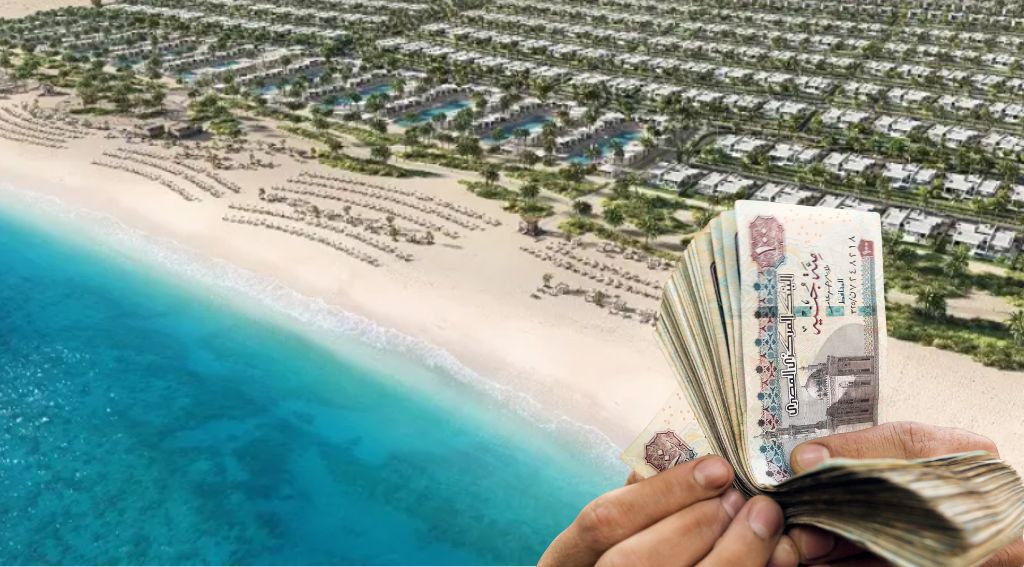

In a significant move that has caught the attention of the global financial markets, Egypt and the United Arab Emirates (UAE) recently inked an agreement for a $35 billion urban development project on Egypt’s northwest coast. This monumental deal, which involves the UAE’s sovereign fund, Abu Dhabi Developmental Holding Company (ADQ), is set to have far-reaching implications on the foreign exchange (forex) market.

| Key Takeaways | Details for Investors |

|---|---|

| Largest foreign direct investment in Egypt’s history | The deal marks the largest FDI in Egypt, potentially attracting over $150 billion |

| Boost to Egypt’s economy and foreign reserves | Expected to alleviate Egypt’s economic struggles and bolster foreign currency reserves |

| Integral part of North Coast Urban Development Plan | Forms a crucial component of a comprehensive urban development strategy for the region |

| Diverse development scope | Encompasses residential, tourism, industrial, financial, and logistical facilities |

| Strategic partnership between Egypt and the UAE | Demonstrates a strong alliance between the two nations, fostering political and economic support within the region |

The backdrop to this development is Egypt’s ongoing economic crisis, characterized by a chronic scarcity of foreign currency inflows. This situation has led to a sharp depreciation of the Egyptian pound against the dollar in informal exchange markets. Amidst this challenging economic landscape, the Egyptian government has been actively seeking ways to attract foreign investment and boost its forex reserves.

The Ras al-Hikma project, described by Prime Minister Mostafa Madbuly as the “largest foreign direct investment deal” in Egypt’s history, is a strategic response to these economic challenges. The project, which will span an area of 170 million square kilometres on the northwest coast, is expected to bring in a total of $150 billion in foreign investments.

The forex implications of this project are manifold. Firstly, the UAE will pay $24 billion of the upfront investment in liquid foreign currency. This influx of foreign currency will provide a much-needed boost to Egypt’s forex reserves and could potentially stabilize the Egyptian pound’s exchange rate.

Secondly, the UAE will convert $11 billion of its existing deposits in the Central Bank of Egypt into investments for ADQ to use in establishing the project. This conversion of deposits into investments will not only reduce Egypt’s debt repayment burden but also inject additional foreign currency into the economy.

Generating forex inflows

The project is also expected to generate substantial forex inflows in the long run. With plans for residential areas, hotels, resorts, a free zone for light and tech industries, a financial and business district, and an international marina for yachts and cruise ships, the city is poised to attract foreign tourists and businesses, thereby earning valuable foreign currency.

Moreover, the establishment of an international airport south of the city will further facilitate foreign tourism and trade, leading to increased forex earnings. The Egyptian government’s 35 percent stake in the project also ensures that a significant portion of these forex inflows will directly benefit the country’s economy.

In conclusion, the Ras al-Hikma project represents a strategic move by Egypt to attract foreign investment, boost its forex reserves, and stabilize its currency. By leveraging the power of forex, Egypt is not only addressing its immediate economic challenges but also laying the foundation for long-term economic growth and stability.

Stop Press – AIBC Africa takes place in Cape Town between 11-13 March !