Korea financial services regulator safeguards Investors from heavy losses

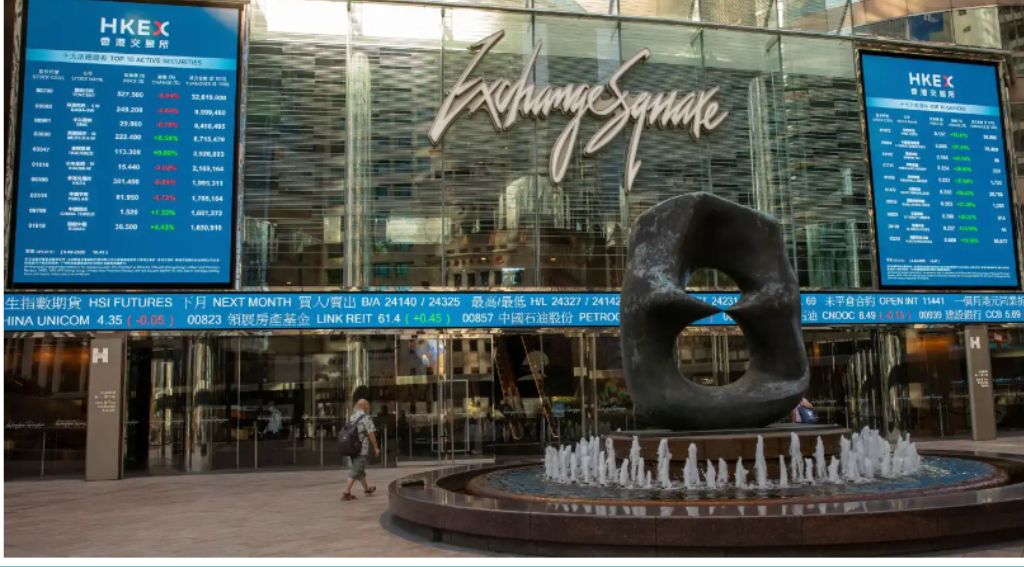

Korea’s financial supervisory service (FSS) is launching an investigation into the sales of derivative products related to Chinese stocks listed on the Hong Kong exchange. The concern is that these products may expose investors to significant losses.

KB Kookmin Bank will be investigated

The FSS will be inspecting 12 local banks and brokerages, including KB Kookmin Bank and Korea Investment & Securities, starting today. These institutions have reportedly sold a total of 19.3 trillion won (US $14.66 billion) worth of equity-linked securities (ELS) products tracking Hong Kong’s H index since 2021.

The FSS has conducted a preliminary review and identified various issues, including inadequate management of the sales cap, failure to store relevant documents, and a policy to sell high-risk, high-level ELS products.

The inspection will cover these concerns, and investigations will take place concurrently with complaints filed against the two major sellers (KB Kookmin Bank and Korea Investment & Securities).

The FSS is particularly worried about potential heavy losses for investors, especially since around 79.6 percent of the outstanding amount (15.4 trillion won) is set to be redeemed in the first half of the current year, and poor performances by the H index may lead to substantial losses.

This situation underscores the importance of regulatory oversight in financial markets to ensure the protection of investors and the stability of the financial system.