- Roadshow to Rome

- Awards

- Exhibitors

- Speakers

- Media Partners

- News

U.S. President Donald Trump has announced the establishment of a U.S. Crypto Strategic Reserve, which will include Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA). This decision, unveiled on his social media site Truth Social, represents a dramatic change in the government’s policy towards cryptocurrency.

Trump’s remarks stressed his intent to make America the world leader in cryptocurrency. Initially, he mentioned only XRP, SOL, and ADA, but later indicated that Bitcoin (BTC) and Ethereum (ETH) would also be included in the reserve.

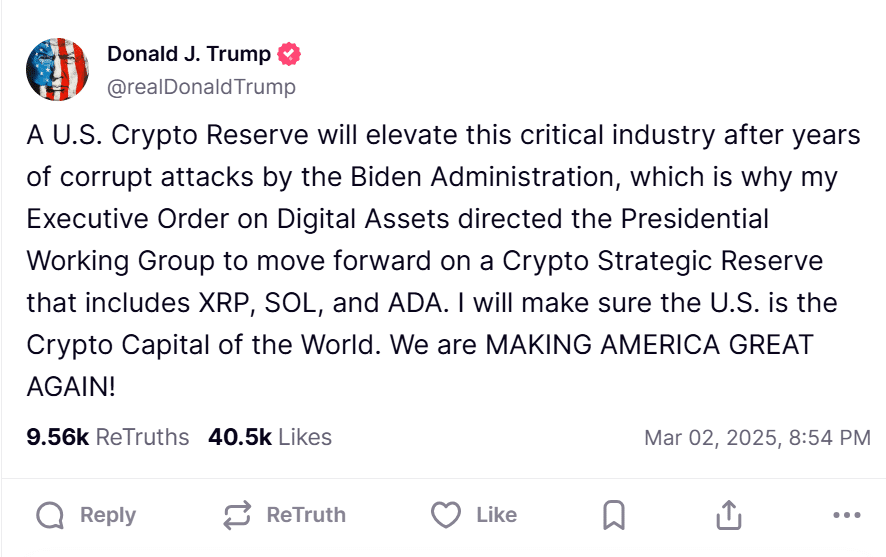

Trump’s post read, “A U.S. Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration, which is why my Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA. I will make sure the U.S. is the Crypto Capital of the World. We are MAKING AMERICA GREAT AGAIN!”

Trump made the announcements on Truth Social, his social media platform.

Following President Trump’s announcement, the prices of XRP, SOL, and ADA saw substantial increases. ADA’s price skyrocketed by over 63 percent within two hours of the announcement, while SOL rose by 23 percent and XRP by 32 percent. Bitcoin, the largest cryptocurrency by market value, climbed more than 11 percent to reach $94,164 on Sunday afternoon. Meanwhile, Ether, the second-largest cryptocurrency, increased by about 13 percent to $2,516.

Trump envisions the U.S. as the dominant player in the crypto space. He aims to reverse the “corrupt attacks” of the Biden administration and create a more crypto-friendly regulatory landscape. Trump has been discussing the concept of a crypto reserve since his 2024 campaign. An executive order signed earlier this year instructed a working group to examine the viability of such a reserve, paving the way for this announcement.

Senator Cynthia Lummis proposed a Bitcoin reserve to accumulate 1 million BTC over five years. While her bill stalled, Trump’s reserve plan seems to take a broader approach by including multiple cryptocurrencies.

Despite initial price surges, the crypto market has faced volatility, with major digital assets experiencing sharp declines. Analysts suggest that factors such as interest rate policies and regulatory clarity from Trump’s administration will dictate the market’s next moves. Although the strategic reserve would greatly contribute to the crypto sector, several issues persist. One of the main issues is market volatility, as cryptocurrency prices tend to be very volatile. Secondly, political pushback may ensue, as some politicians might oppose the concept of government-sponsored crypto holdings. Lastly, regulatory barriers need to be overcome, as implementing transparent and efficient policies will be vital to the success of the reserve.

“The allocation will likely be a rounding error compared to national reserves, gold holdings, and trade agreements. The bigger concern is the psychological effect—if the U.S. legitimises Bitcoin as a reserve asset, it could trigger a wave of unsophisticated retail investors piling in without understanding the volatility or diversification risks,” he added.

When asked about the market reaction in the short and long term, especially for smaller market cap coins like XRP, ADA, and Solana, d’Anethan noted that in the short term, the impact is already visible. ADA jumped 30-50 percent, driven by lower liquidity and the unexpected nature of the news. SOL and XRP are riding the same wave. It’s notable that these assets align with Bitwise’s top fund holdings, which crypto czar David Sacks—likely an influential voice in this policy shift—is directly involved with.

In the longer term, it still comes down to fundamentals. According to the crypto-expert, the real test for ADA, SOL, and XRP isn’t this announcement—it’s whether their ecosystems can build compelling, widely adopted solutions. However, d’Anethan also opined that this move clears a major psychological barrier. “Governments, sovereign wealth funds, and large institutional players now have a green light to allocate without fearing reputational risk. That’s a powerful shift,” he said.

Regarding measures investors should take to protect their investments and capitalise on potential opportunities, d’Anethan advised against succumbing to FOMO (Fear of Missing Out). If investors are only reacting now, chances are, the first wave of the trade has already played out, and the market is in a slight pullback.

That said, the long-term implications are undeniable. Having the U.S. government vouch for crypto as a strategic asset class is a seismic shift. Over time, this could drive fresh capital into the space, lifting not just BTC and ETH, but also altcoins that haven’t yet seen their moment, d’Anethan noted. He added that the key is disciplined positioning. “Investors should avoid chasing euphoric pumps and instead look at where institutional money might flow next. This is likely just the beginning of a broader reallocation into digital assets.”