AIBC Insight: Impact of fintech on Commercial Real Estate

Commercial Real Estate (CRE) is one of the numerous sectors that has reaped the benefits of financial technology (FinTech). With an ever-growing population, commercial real estate is becoming increasingly crucial, since every office block, retail mall and high-rise building relies on CRE lender funding to survive.

AIBC News speaks with global financial services expert Nick Glinsman to better understand the emergence of fintech in the Commercial Real Estate sector.

Nick Glinsman, Partner at Malgram and Glinsman Research says that according to analysts Cohen & Streers, banks held US $1.73 trillion or 38.4 percent of US $4.5 trillion CRE (Commercial Real Estate) mortgages of income producing properties. Investors and government entities held or guaranteed the remaining 61.6 percent. Glinsman explains that this is US $1.73 trillion in CRE debt that is spread over 4,132 banks.

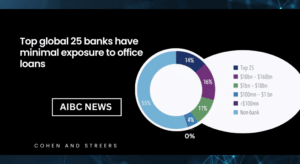

In the broader sense, banks hold 45 percent of US $2.25 trillion of all CRE mortgages with the top 25 banks holding 14 percent of CRE debt and this is about 4 percent of their total assets. 100 banks with assets of around US $10 billion to US $160 billion held US $800 billion which is 16 percent of CRE debt. The smaller banks, around 4,000, held US $750 billion which is 15 percent of the total CRE Market.” Nick Glinsman, Partner – Malgram and Glinsman Research

Technology is transforming commercial real estate in the same manner that it has shook up consumer finance. Real estate continues to attract capital and this demonstrates its advantage over other assets in an otherwise volatile investing climate characterised by rising inflation.

Regional and smaller banks are more exposed to CRE

In recent years, the CRE model has changed as a result of the impact of Fintech.

On average, says Glinsman, CRE exposure amounts to 20 percent of the total assets of regional and smaller banks. He adds that “there is a huge diversity of small local players that know their local markets”.

In the analysis by Cohen & Steers. office mortgages account for only 3 percent of their total assets. According to Glinsman, office CRE is too small to cause trouble to the smaller banks however a few may be heavily exposed with a result that they may have a negative impact.

Glinsman calculates, as an example, that in the case of a bank with US $1 billion assets and a CRE exposure of 20 percent, this would mean that the bank is sitting on US$200 million in all kinds of CRE loans.

This would indicate, that as an average, that the bank would also be exposed to office mortgages amounting to 32 percent of its assets or around US $30 million. Glinsman argues that a ‘handful’ of the 4,000 small banks have exposure to ‘concentration risk’ with CRE that exceeds 50 percent of their assets. As a result if they run into trouble, they may become yet another ‘failed bank’.

FinTech gained major significance in the sector

Fintech makes transactions easier and quicker and also minimizes potential fraud. The size of the professionally managed global real estate investment market increased from US $9.6 trillion in 2019 to US $10.5 trillion in 2020.

Blockchain-powered platforms focussed on CRE will eventually undertake functions such as payment, legal documentation, and listings. Innovation in CRE financial services can already be achieved by means of new technologies. Examples are regtech (regulatory technology), wealthtech (digital wealth management tools), proptech (property technology) and insurtech (insurance technology). The advanced tools will provide buyers, sellers and loan providers with the opportunity to get more value out of their money as the full cycle of the service via blockchain will eliminate any commissions or third party fees and services.

The top global 25 banks have minimal exposure to office loans. According to Glinsman, office mortgages account for less than 1 percent of the total assets of the top 25 banks as they have relatively little exposure to office loan. The impact of a default in office CRE would not be an existential crisis but will cause a negative impact on earnings.

As emerging tech matures, its capacity to increase CRE value will increase.

Investors will experience biggest hit on CRE debt

Investors and non banks will experience the biggest hit on CRE mortgages. Glinsman points out that some of the categorised participating investors would most likely include shadow banks. Some banks will not survive as a result of their exposure to CRE debut while other banks will be taken down by other factors.

Credit risk, interest-rate risk and concentration risk should be well managed by the banks. If they are not well managed, the result is that the banks will fail. Investors have been taking big losses on CRE equity and debt for many years. This will continue and likely get worse. Everyone will learn that you can still lose money in real estate. However Glinsman does not think that CRE will lead to the next big banking crisis.

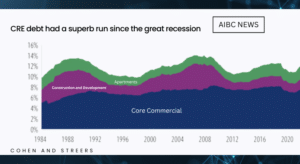

CRE debt had a superb run since the great recession as shown in the graph below.

New loan originations grew consistently at a compounded annual growth (CAGR) of 13 percent from the lowest level observed in 2010 until 2022.

Banks were the largest contributors at 23 percent to the origination volume growth followed by live companies at 16 percent. In 2020, there was a slight downturn with the initial outbreak of the pandemic but steady growth resumed fairly quickly.

First Republic Bank ‘s CRE portfolio represents only 6% of total loans

JP Morgan analysts consider that banks with a ratio greater than 100 percent between commercial real estate loans to capital are in a risky position. The only three US banks with high ratios this month are Valley National with a ratio of 485 percent, East West Bank with a ratio of 230 percent and Synovus Financial with a ratio of 196 percent.

Analysts warn that if these three banks report much higher CRE loan loss provisions in their Q4 2023 results, depositors could get nervous and it may result in a bank run.

Way forward for FinTech

The CRE market has experienced major changes new emerging technologies have evolved and the rise of FinTech solutions. Tokenization and CRE online platforms are emerging as advanced tools in the market. New services are introduced nearly on a daily basis as a result of start-ups incubating new ideas.

AIBC News was speaking with Nick Glinsman, a global markets strategist. He is co-founder and managing partner of Malmgren Glinsman Partners and specialises in geopolitical analysis and financial services and research. He is former Managing Director at Salomon Brothers.

Related topics:

First Republic Bank in crisis – another casualty for US banking

Theranos founder appeals against prison sentence

Abu Dhabi Securities Exchange welcomes first listing from UAE

Stop Press ! Find out more about AIBC Asia Summit