Top 10 facts to consider before investing in digital Yuan

China is currently testing its first national digital currency, raising the question: Invest or not?

Following an era of strong decentralised cryptocurrencies from all around the world, nation states are finally chipping in into the technology of digital money. With China’s digital Yuan, also called DCEP (Digital Currency Electronic Payment), interest in new possibilites for currency investment have emerged. Before jumping on the bus to profit from China’s progressive move towards the technology of blockchain, these 10 key aspects should be considered. State currencies are linked to global geo-political contexts. Check out the five major advantages of the Chinese digital Yuan, but consider the five cons as well.

1. Test results are amazing

In the past year, China has conducted large experiments to assure a high efficiency of the new digital coin, with further tests being conducted in April and May 2021 in a large number of cities. The performance data so far can be interpreted as overwhelmingly positive, with Chunqiu Airlines, the first aviation company to ever engage in digital transactions with digital money showing support and accepting payments in digital Yuan. Therefore, there is nothing standing in the way of a stable start in the more than a billion people economic powerhouse of China. The currency is shown to be effective and discrete.

2. The Covid-19 pandemic was a booster

The Covid-19 pandemic has changed the way users think and behave in many ways. The call for hygienic zero-contact payment has increased global support for digital currencies, and companies are beginning to react. While China is one of the world’s first major economies to rise up from the health crisis, they could raise the value of digital Yuan together with their industry.

3. Foreign firms are joining in

Global interest is already rising. McDonald’s and Starbucks are some of the first foreign companies to allow payment in China’s digital currency, linking the new digital currency to the U.S. market. This is an important step in the process of establishing the DCEP, and could likely inspire other international brands to join as users.

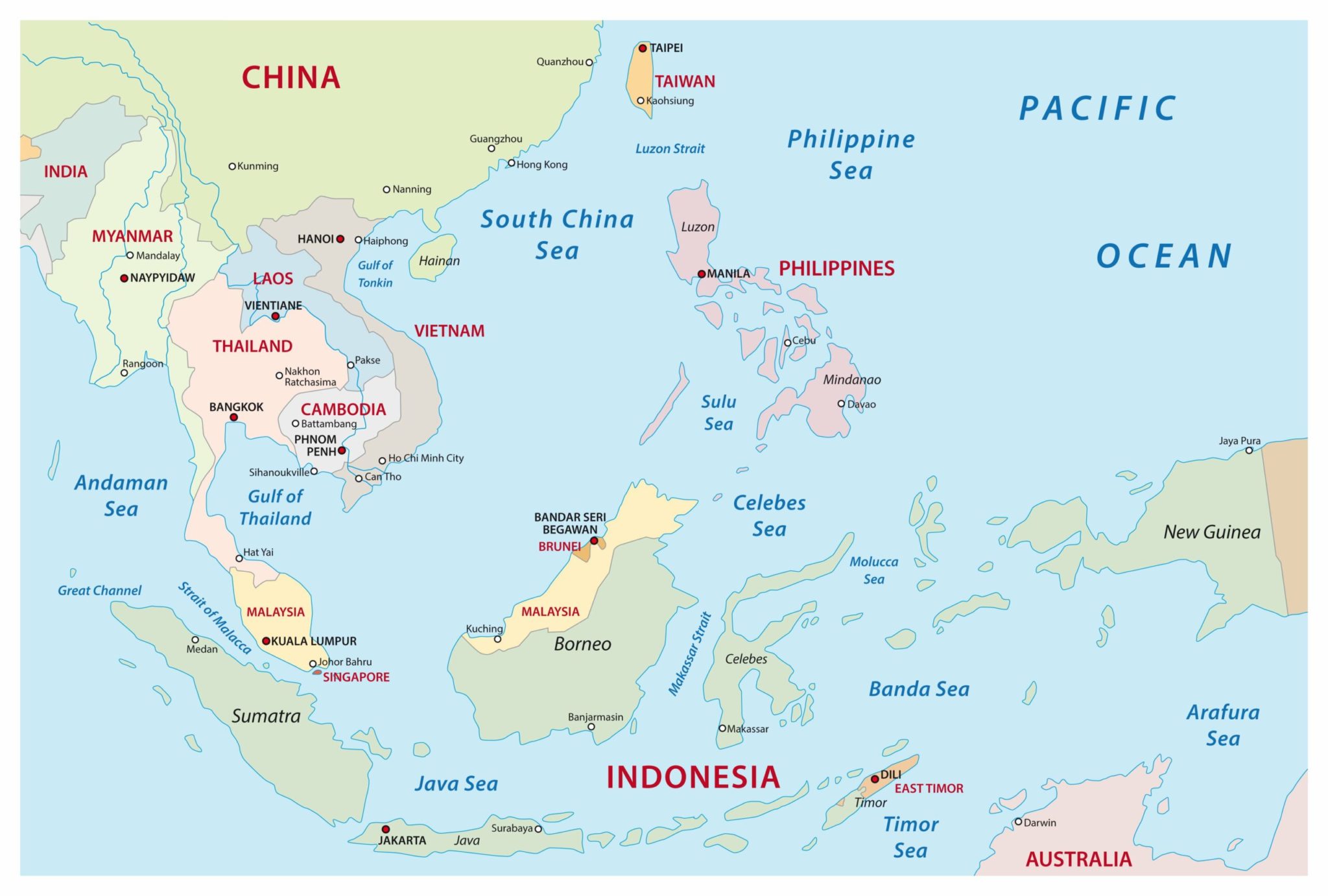

4. DCEP circumnavigates U.S. sanctions

While the U.S. heavily impacted Chinese exports through sanctions, the digital currency is to China what the Petro was for Venezuela. A technology to circumnavigate U.S. foreign sanctions. By enabling payments in digital Yuan for trade partners like Russia or Iran, transactions are not only more efficient, but also less vulnerable to economic attacks, securing more power on the global market and strengthening the Chinese industry.

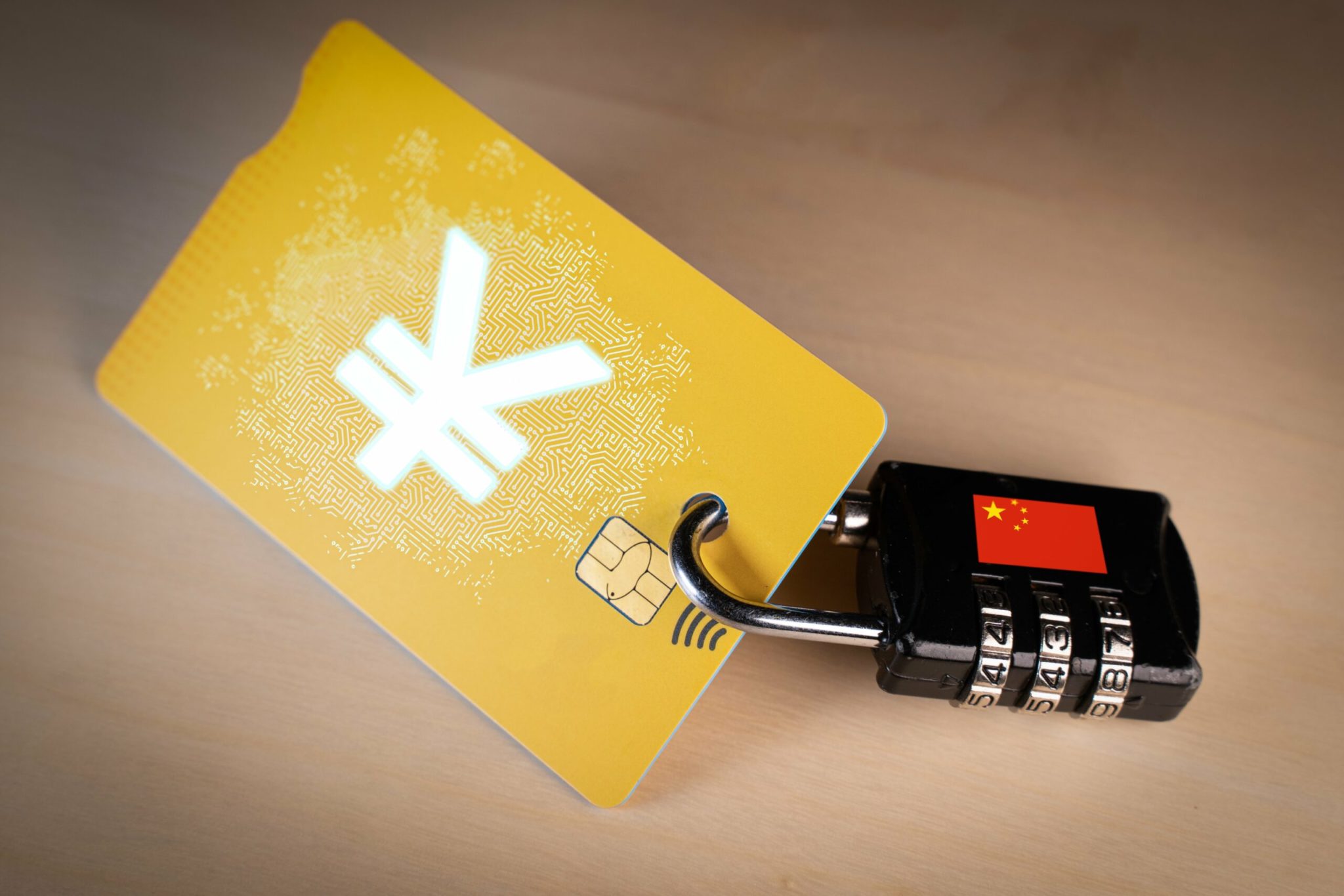

5. Centralisation…

It must be made clear that the digital Yuan is not a currency that can be farmed like bitcoin. It is a digital version of the Renminbi, that means it is issued by central institutions of China. This makes it far less volatile than the currently largest digital currencies, encouraging private investment, while keeping many of the practical advantages…

6. …Centralisation

…and disadvantages. The digital Yuan, despite China pursuing efforts to internationalise their DCEP, is likely to remain a national currency for a long time, since it is tied to a central banks. There is little space for a hype to occur as has for other digital currencies using blockchains, such as with Bitcoin. So investing in digital Yuan is quite similar to investing in traditional options, with additional cons to keep in mind.

7. Chinese interventions as wild card

For a currency to find its worth on the market, free flow of capital is vital, and China does not have a free market system. Interventionist market policies of the Chinese government however make it very plausible that the worth of digital Yuan could be changed with little chances for investors to keep their influence.

8. Aggressive policies bare potential for problems

Whether a daring move by China is probable cannot be answered with any certainty, however the presence of these conflicts could diminish trust in the financial innovation and suppress the value of the new Yuan.

9. Too few imports

In order for the digital Yuan to expand, China will need to import more international goods from other Asian countries and beyond. That way, the electronic money would circulate to new markets and gain actual value. Currently, the currency would not be able to gain much worth while China relies mainly on global exports, since this reduces the transactions to foreign currencies.

10. Zero Privacy

Fears of private transactions being watched by the government of China when using the DCEP are high, due to the strict surveillance measures and collection of data without consent imposed throughout the country. For potential users to trust the system, either the promotion or the actual policies must be adjusted.

AIBC UAE will take place on the 25th to 26th May, 2021, in the emirate of Dubai. The event will bring together key brands and individuals from the converging sectors of AI, blockchain, IoT, Quantum Tech to discuss and shape the future of emerging tech.

It is one of the leading events globally for blockchain, AI, crypto, and other emerging technologies, and gathers together an elite selection of delegates, policymakers and thought leaders from across the globe. Such international recognition has helped propel AIBC Summit become a favourite on the world circuit for emerging tech conferences and expos.