- SUMMITS

- NEWS & MEDIA

- SUMMITS

- NEWS & MEDIA

The cryptocurrency community is abuzz with President Donald Trump’s World Liberty Financial (WLFI) cryptocurrency project, which has raised a further $250 million from its second token sale. The total amount raised now stands at an astronomical $550 million, representing a significant milestone for the development of the project.

WLFI is closely related to the Trump family and is touted as a revolutionary decentralised finance banking platform. The growing interest from high-profile investors and regulatory scrutiny, along with the necessary political connections, is making headlines in both the financial and political worlds.

World Liberty Financial aims to revolutionise the way individuals engage with digital currencies. Officially launched in October, just weeks before Trump’s election, WLFI was promoted as a next-generation DeFi platform. A report published during the launch of WLFI suggested that the Trump family may take home 75 percent of net revenue, raising eyebrows among investors and regulators alike.

The latest funding round saw a massive $250 million poured into WLFI, demonstrating investor confidence in the platform’s vision. The company sold $300 and $250 million worth of Ethereum, Bitcoin, Tron, Ondo, Sui, and other cryptocurrencies in two sets of token sales. The announcement by WLFI stated that more than 85,000 people completed Know Your Customer (KYC) verifications to participate in the sale, indicating widespread interest from across the crypto spectrum.

WLFI’s co-founder, Zach Witkoff, son of billionaire Steve Witkoff, stressed that the project is poised to transform DeFi and global finance. According to Witkoff, WLFI’s success reflects the deep understanding of crypto and finance among its supporters.

Witkoff stated, “This milestone proves that those who truly understand crypto and finance recognise what we’re building—and that WLFI is on track to supercharge DeFi as it transforms global finance in the coming years.”

Tron blockchain creator Justin Sun has significantly increased his holding in WLFI tokens to $75 million, showing faith in the long-term prospects of the project. David Sacks, Trump’s AI and crypto czar, reportedly sold more than $200 million in cryptocurrency holdings prior to taking up his position. His participation indicates a robust regulatory approach in the administration.

Witkoff further added, “The token sales are just the beginning. We’re gearing up to launch a wave of disruptive technology that will redefine the boundaries of what’s possible with digital assets.”

President Trump recently signed an executive order establishing a Strategic Bitcoin Reserve, reinforcing his administration’s pro-crypto stance. In a landmark decision, the SEC announced that meme tokens are not considered securities. A court filing in February revealed that Justin Sun and the SEC are in discussions to resolve Sun’s civil fraud case, adding regulatory uncertainty to his WLFI investment. With the Trump family deeply involved in WLFI’s financial structure, scrutiny from regulators is inevitable. Whether WLFI can navigate these challenges will determine its long-term success.

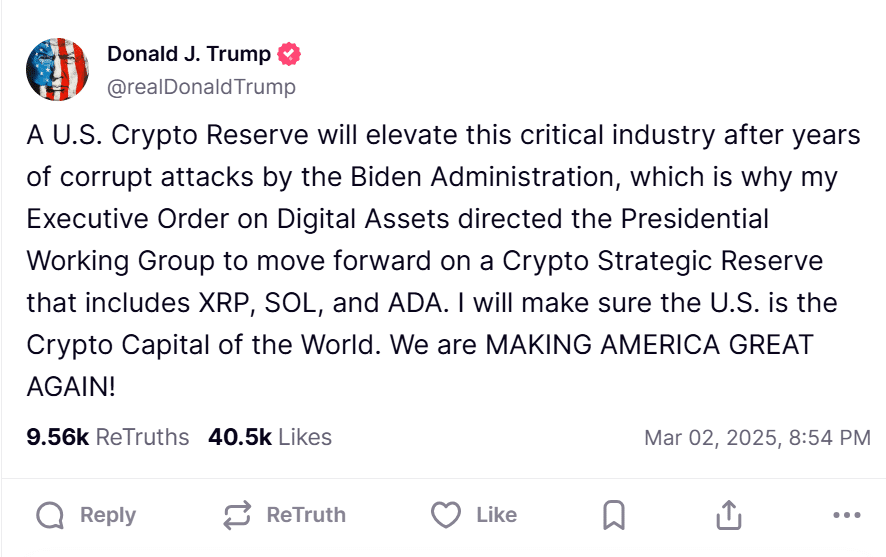

U.S. President Donald Trump has announced the establishment of a U.S. Crypto Strategic Reserve, which will include Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA). This decision, unveiled on his social media site Truth Social, represents a dramatic change in the government’s policy towards cryptocurrency.

Trump’s remarks stressed his intent to make America the world leader in cryptocurrency. Initially, he mentioned only XRP, SOL, and ADA, but later indicated that Bitcoin (BTC) and Ethereum (ETH) would also be included in the reserve.

Trump’s post read, “A U.S. Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration, which is why my Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA. I will make sure the U.S. is the Crypto Capital of the World. We are MAKING AMERICA GREAT AGAIN!”

Trump made the announcements on Truth Social, his social media platform.

Following President Trump’s announcement, the prices of XRP, SOL, and ADA saw substantial increases. ADA’s price skyrocketed by over 63 percent within two hours of the announcement, while SOL rose by 23 percent and XRP by 32 percent. Bitcoin, the largest cryptocurrency by market value, climbed more than 11 percent to reach $94,164 on Sunday afternoon. Meanwhile, Ether, the second-largest cryptocurrency, increased by about 13 percent to $2,516.

Trump envisions the U.S. as the dominant player in the crypto space. He aims to reverse the “corrupt attacks” of the Biden administration and create a more crypto-friendly regulatory landscape. Trump has been discussing the concept of a crypto reserve since his 2024 campaign. An executive order signed earlier this year instructed a working group to examine the viability of such a reserve, paving the way for this announcement.

Senator Cynthia Lummis proposed a Bitcoin reserve to accumulate 1 million BTC over five years. While her bill stalled, Trump’s reserve plan seems to take a broader approach by including multiple cryptocurrencies.

Despite initial price surges, the crypto market has faced volatility, with major digital assets experiencing sharp declines. Analysts suggest that factors such as interest rate policies and regulatory clarity from Trump’s administration will dictate the market’s next moves. Although the strategic reserve would greatly contribute to the crypto sector, several issues persist. One of the main issues is market volatility, as cryptocurrency prices tend to be very volatile. Secondly, political pushback may ensue, as some politicians might oppose the concept of government-sponsored crypto holdings. Lastly, regulatory barriers need to be overcome, as implementing transparent and efficient policies will be vital to the success of the reserve.

“The allocation will likely be a rounding error compared to national reserves, gold holdings, and trade agreements. The bigger concern is the psychological effect—if the U.S. legitimises Bitcoin as a reserve asset, it could trigger a wave of unsophisticated retail investors piling in without understanding the volatility or diversification risks,” he added.

When asked about the market reaction in the short and long term, especially for smaller market cap coins like XRP, ADA, and Solana, d’Anethan noted that in the short term, the impact is already visible. ADA jumped 30-50 percent, driven by lower liquidity and the unexpected nature of the news. SOL and XRP are riding the same wave. It’s notable that these assets align with Bitwise’s top fund holdings, which crypto czar David Sacks—likely an influential voice in this policy shift—is directly involved with.

In the longer term, it still comes down to fundamentals. According to the crypto-expert, the real test for ADA, SOL, and XRP isn’t this announcement—it’s whether their ecosystems can build compelling, widely adopted solutions. However, d’Anethan also opined that this move clears a major psychological barrier. “Governments, sovereign wealth funds, and large institutional players now have a green light to allocate without fearing reputational risk. That’s a powerful shift,” he said.

Regarding measures investors should take to protect their investments and capitalise on potential opportunities, d’Anethan advised against succumbing to FOMO (Fear of Missing Out). If investors are only reacting now, chances are, the first wave of the trade has already played out, and the market is in a slight pullback.

That said, the long-term implications are undeniable. Having the U.S. government vouch for crypto as a strategic asset class is a seismic shift. Over time, this could drive fresh capital into the space, lifting not just BTC and ETH, but also altcoins that haven’t yet seen their moment, d’Anethan noted. He added that the key is disciplined positioning. “Investors should avoid chasing euphoric pumps and instead look at where institutional money might flow next. This is likely just the beginning of a broader reallocation into digital assets.”

When most people hear “blockchain,” they immediately think of Bitcoin. But blockchain technology extends far beyond cryptocurrency; it’s driving innovation across multiple industries, including entertainment, gaming, finance, and even healthcare. In a tech-forward nation like Australia, blockchain is rapidly changing the way people engage with digital services, attracting significant public and private investments and laying the foundation for a more transparent and secure digital ecosystem.

Blockchain is a decentralised and distributed ledger technology that records digital transactions securely and transparently. Since transactions on a blockchain don’t require a central authority or intermediary like a bank, they offer greater security, anonymity, and efficiency. This makes blockchain a game-changer in financial services, digital payments, and even entertainment platforms.

In Australia, blockchain is gaining traction across multiple industries, with gaming, finance, and retail among the top adopters. However, regulatory restrictions still apply, especially in the use of crypto for gaming transactions. If you’re considering using digital currencies for gaming, it’s wise to check reputable review platforms like CasinoBuddies, which lists not only the most recommended real-money online pokies casinos in Australia but also the top crypto casinos that accept digital currencies such as Bitcoin and Ethereum.

Beyond financial services, blockchain is also transforming supply chain management. Companies are using blockchain to track the movement of goods and verify authenticity, reducing fraud and improving efficiency. This is particularly important in industries such as food production and pharmaceuticals, where trust and transparency are paramount.

Beyond financial transactions, blockchain plays a crucial role in the development of Web3, ushering in a new era of decentralised applications. By integrating blockchain with Web3 technologies, businesses can build more secure, user-controlled platforms, allowing individuals to manage their digital identities and personal data without third-party interference.

A great example of this is in the gaming sector, where blockchain supports crypto-friendly online pokies. These platforms provide increased privacy, instant payments, and greater transparency. Blockchain’s algorithms also ensure game outcomes are completely random and provably fair, boosting trust and confidence among players.

Additionally, Web3 and blockchain technology are creating new opportunities in content creation and social media. Decentralised platforms allow creators to monetise their work directly without relying on traditional intermediaries like large streaming services or publishing houses. This shift gives artists, musicians, and writers more control over their intellectual property and revenue streams.

One of the most exciting applications of blockchain is tokenisation, the process of transforming real-world assets into digital tokens. This allows assets like real estate, art, and commodities to be traded more efficiently, reducing reliance on intermediaries and increasing liquidity and transparency.

A 2019 study revealed that small-to-medium-sized businesses in New South Wales and Victoria were among the first to explore tokenisation, viewing it as the next step in Australia’s evolving financial landscape. However, despite its potential benefits, regulatory challenges remain a significant hurdle. The Reserve Bank of Australia (RBA) is currently exploring the possibility of launching a central bank digital currency (CBDC) to facilitate tokenised banking transactions, which could help cut costs and enhance efficiency in the financial market.

Beyond financial assets, tokenisation is also making waves in the entertainment industry. Musicians and artists are experimenting with NFTs (non-fungible tokens) to sell exclusive content, concert tickets, and digital collectibles directly to fans. Similarly, sports franchises are leveraging tokenisation to offer unique fan experiences, including digital ownership of memorabilia and VIP access to events.

With cyber threats becoming more sophisticated, blockchain is emerging as a powerful tool for enhancing digital security. By decentralising data storage, blockchain reduces the risk of hacks and data breaches. In Australia, businesses and government agencies are exploring blockchain-based identity management systems to protect user data while ensuring seamless verification processes.

For example, blockchain can be used to create tamper-proof health records, allowing patients to control access to their medical history without relying on a centralised database. This technology has the potential to improve patient care and streamline medical processes while safeguarding sensitive information from cyber threats.

Blockchain is undeniably reshaping how Australians interact with digital services. From financial applications to gaming, tokenised assets, and security solutions, the opportunities are vast. However, regulatory compliance remains a major challenge that could impact the speed of widespread adoption.

Despite these obstacles, Australia’s digital economy is on an exciting trajectory. With continued innovation and investment, blockchain’s influence will only expand, paving the way for a more secure and decentralised digital future. As more industries recognise the benefits of blockchain, Australians can expect a wave of new digital services that prioritise security, efficiency, and transparency.

U.S. President Donald Trump and First Lady Melania Trump have entered the realm of digital assets by launching their respective meme coins, $TRUMP and $MELANIA. These tokens, launched in mid-January 2025, exhibit very high volatility, highly responsive to the unpredictable meme coin market. On 17 January 2025, just days before his inauguration, Donald Trump unveiled the $TRUMP meme coin. Initially met with scepticism due to the absence of a formal announcement, the coin’s legitimacy was later confirmed through Trump’s posts on social media platform X.

My NEW Official Trump Meme is HERE! It’s time to celebrate everything we stand for: WINNING! Join my very special Trump Community. GET YOUR $TRUMP NOW. Go to https://t.co/GX3ZxT5xyq — Have Fun! pic.twitter.com/flIKYyfBrC

— Donald J. Trump (@realDonaldTrump) January 18, 2025

The $TRUMP coin’s logo features a cartoon depiction of Trump raising his fist, commemorating his survival of an assassination attempt in July 2024. The project’s website emphasised that the coin was “not intended to be, or the subject of” an investment opportunity or security and was “not political and has nothing to do with” any political campaign, political office, or government agency. The terms prohibited buyers from participating in class-action lawsuits against the project and asserted indemnity against any claims.

Following its launch, $TRUMP’s price surged by over 300 percent overnight. Within two days, it became the 19th most valuable cryptocurrency globally, boasting a total trading value of nearly $13 billion, with each of the 200 million tokens valued at approximately $64 by the afternoon of 19 January. Reports indicated that Trump affiliates controlled an additional 800 million tokens, potentially significantly elevating Trump’s net worth.

Two days after $TRUMP coin launched, Melania Trump introduced her meme coin, $MELANIA. The Solana-based token quickly achieved a valuation of $12 billion within three hours of its launch. However, the construction and security measures of the project’s website have been criticised, which has led to questions about its legitimacy.

The Official Melania Meme is live!

You can buy $MELANIA now. https://t.co/8FXvlMBhVf

FUAfBo2jgks6gB4Z4LfZkqSZgzNucisEHqnNebaRxM1P pic.twitter.com/t2vYiahRn6

— MELANIA TRUMP (@MELANIATRUMP) January 19, 2025

The excitement surrounding both meme coins was short-lived. By 21 January 2025, the price of $TRUMP had declined by around 50 percent, falling from a high of $74 to about $38. Similarly, $MELANIA experienced a significant decrease, with its market capitalisation falling from $2 billion to $790 million.

As of 31 January 2025, $TRUMP is trading at approximately $0.745, reflecting a 0.11 percent decrease from the previous close, with an intraday high of $0.842 and a low of $0.742. Meanwhile, $MELANIA is priced at around $2.09, experiencing a 0.07 percent decline, with an intraday high of $2.30 and a low of $2.05.

These high-profile launches of meme coins have sparked public debate within cryptocurrency circles. This speculation, often likened to gambling, threatens the reputation and future value of the field. Some are considering the involvement of gaming commissions to regulate the volatility issues associated with the inherent lack of value of the underlying asset.

Moreover, as meme coin-based exchange-traded funds (ETFs) from asset managers gain momentum, there are apprehensions about creating “casino-type” speculation in the financial markets. The future of such digital assets will largely be dictated by the U.S. Securities and Exchange Commission’s response.

Speaking exclusively with AIBC World, Justin d’Anethan, Head of Sales at Liquifi, a token launch service company based in the US, shared his views on the profound positive and negative impacts of this phenomenon. He elaborated on the promising future of the market and helped us to understand the intricate dynamics at play.

AIBC: What are the positive and negative impacts of the $TRUMP meme coin, which we’ve seen in the past week?

Justin d’Anethan, Head of Sales at Liquifi: The old industry is split between positive and negative. On the positive side, I think there are three dynamics that are coming across. The first one is it’s very supportive for the crypto space that the US president and administration would be getting involved with crypto. There’s just a very good signal in terms of support from that point.

The second one is it gives a little bit more leeway, a little bit more room for activity from a legal perspective because you kind of assume that if you’re a company and you’re operating in crypto, as long as you’re not doing something too shady, if you’re just acting on it with best intentions, you shouldn’t.

Then the third part is it sends a signal to a lot of companies that are not involved in crypto, that they can now get involved in crypto. So, if you’re Apple or Microsoft or a small company or an NFT or media or gaming and you want to do something with crypto, go ahead and do it because it’s okay.

And the negative point that we have noticed that there was a liquidity event that happened with all the other coins. So essentially, the one you were talking about with the concentration, which is you have the Trump coin launching. And all the capital that was allocated and staying with. But that feels very negative for this. It’s right because of course, it’s cool that there’s volume and activity, but if we’re being honest with ourselves, like a meme coin is just a meme coin, right? It’s not building DeFi solutions or creating an ecosystem in which people can do a variety of stuff.

Another disappointing thing within all this is if you look at the total market cap of crypto, it hasn’t moved up by that much during the events. So essentially what that means is that the capital that was traded was crypto native guys and not necessarily people outside of crypto. They didn’t have the time because you needed a Solana wallet, you needed to go onto the right DEX, needed to be aware of the thing happening. And by the time you were aware, the Trump coin was already down quite a lot, and the Melania token was out and already down quite a lot and then the Baron token and kind of went cascading down that way.

AIBC: Do meme coins pose any concerns regarding financial stability and national security?

d’Anethan: Not at all. I think even though there’s a big speculative element to meme coins, I think people, even the average investor, are smart enough and knowledgeable enough to understand that it is very speculative, that it is very volatile, right? So, I don’t think anybody is under the illusion that if they buy a Trump Coin or a Melania Coin, that it is the same as the S&P 500 or investing in IBM, Microsoft, and Apple, right? So, I don’t think any of the large, sophisticated players will get involved in meme coins, or if they do, they’ll do it in a very smart way. And so, I don’t think it will, in fact, affect the stability of financial markets. I think it might hurt a lot of retail users, the ones that will be on the losing end of the trade.

AIBC: What are the key security and privacy concerns in the cryptocurrency space?

d’Anethan: I still think one of the core values of crypto is the privacy side of things, and so I think that relative to any other industry, especially if you’re thinking about Web2 and kind of centralised models, the privacy concerns should always be higher because you’re essentially trusting a large company that typically wants to monetise its user info. The only thing is a lot of hacks, and a lot of scams do happen in crypto because, of course, the whole responsibility of that privacy and safety is on the user side of things. If you’re doing everything right, you should never get hacked because the blockchain itself cannot get hacked.

I think as more and more people get involved, you will see more of those incidents. It won’t be a fault of the blockchain in terms of architecture. It would be a fault of the user, but just because of ignorance or inexperience. You cannot share private keys, you cannot interact with something that is not audited, you shouldn’t click on links that you don’t know, or interact with people that you don’t know online, people that reach out to you without you having to reach out to them first, and so on.

AIBC: How will meme coin culture impact the market in the coming year?

d’Anethan: I want to be optimistic here and I want to think that it’s going to onboard more users. Do you know what I mean? It’s like the NFT craze of the 2020-2021 bull market where, you know, you talk to your grandmother and she was trading an NFT and you’re like, huh, how did that happen, right? And it’s like if it gets cool enough and popular enough, it will get a lot of people to at least create a wallet, try some transactions, buy some Ethereum, buy some Solana, you know, do something to participate in that speculation.

Whenever you have a trend that’s very explosive, it goes on for a while, but you cannot sustain super big growth. You can do it for six months, you can do it for 12 months or 18 months, but at some point, people are like, you know, I didn’t make as much money as I thought. I made a lot of money, but now I’m not making as much money. And so, I should kind of cool down and take my money off the table. And so, you’re going to see some losers at the end of the trend and some winners maybe at the beginning, but yeah, that’s my perspective on it.

AIBC: What is your prediction for the Asian crypto market dynamics?

d’Anethan: I’m going to give you a positive and a negative view on the market because I think on the positive side, I think a lot of jurisdictions, a lot of countries, again, are going to try to catch up to the US and show that they’re active. You’ll have a lot of countries like maybe Korea or Japan or Thailand or Hong Kong or Singapore kind of supporting the crypto space because, again, they want to maintain relevance relative to the other countries. And that’s supportive for the crypto space. And there’s a lot of traders in Asia, right? A lot of the trading activity in India, but also in Korea and Japan and Southeast Asia is very big, so it’s a thing. And so, I think that will be positive.

I’m just talking about traditional markets in general. I think the theory is that Trump is going to keep or impose tariffs on the Asia side of things. He’s going to dampen enthusiasm. That’s on the market, but it still has an impact in terms of how much money people have in the region. And if they feel a bit more fearful, there’s less liquidity, there’s less certainty. It’s harder for them to get involved in speculative assets like new crypto projects, for example. And so, I’m positive for the crypto space. I think there’s still going to be a lot of traders.

AIBC: How do you see the crypto market evolving in the next 6–12 months?

d’Anethan: I’m not allowed to give any kind of financial advice, so I’m just sharing it from an opinion perspective. First, there are some dynamics that I think we will see unfold, which is essentially you’re going to see a lot more celebrities and companies getting involved in crypto, and that’s presumably going to be positive. It just means a lot more people are aware of those solutions and getting set up or involved with DeFi solutions. The other thing is I think a lot of asset managers, sovereign wealth funds, and governments are going to have to start looking at crypto. And it’s not a question of whether they like it or not. It’s just that if the US is doing it, and if you want to stay relevant, you need to have some kind of activity, some kind of, at least in opinion, we really don’t like it.

There is some kind of strategic reserve, like a strategic Bitcoin reserve as it’s been discussed for the US, but maybe other governments will follow suit. That will be just insane, basically. So, if the US does that, a lot of other countries will have to follow. And then there’s no more price target. It just can go up so much that you just don’t even know where to draw the line. AI coins are probably going to be very trendy. I’m not really confident myself if there’s actual value or substance behind those tokens, but I think it’s a narrative that people are going to pile into because 2025 AI is the thing, and if crypto becomes the thing, then some people are going to put two and two together and kind of do an AI crypto.

Over the past decade, online poker and cryptocurrency have both skyrocketed in popularity. This has created an interesting collision for players who wish to enjoy playing poker with the security, flexibility, and decentralised benefits offered by crypto.

In this comprehensive guide, we’re exploring the pros and cons of playing poker with cryptocurrencies. We’ll also examine a range of reliable and popular cryptocurrencies (beyond Bitcoin) used for buy-ins and dive deep into the aspects players should consider before funding poker games with cryptocurrency.

Crypto poker can be described as traditional online poker where players fund their buy-in or accounts using digital currencies as opposed to fiat money. This form of online poker became popular as cryptocurrencies like Bitcoin started gaining mainstream acceptance and adoption.

From this crypto integration into online gambling sites, players saw that crypto payments offered decentralised, fast, and relatively anonymous transactions. Due to this popularity, a number of online poker platforms have embraced crypto payment methods and allow users to buy into poker games using Ethereum, Litecoin, Bitcoin, and other altcoins.

These days, we also have a new breed of online casinos that can be played directly from the messaging app Telegram. Such platforms, like TG Casino, which has been voted the best Telegram casino, allow users to buy into poker and other live casino games using cryptocurrencies. Because of this, players can enjoy secure gambling, improved privacy, instant withdrawals, and rapid transaction times, all from the comfort of their smartphone, tablet, or laptop. These gaming options have already gained significant popularity among Telegram users, and the future growth of crypto will only make them more attractive for crypto players.

Online crypto poker offers distinct advantages, specifically for players who value control over their funds, anonymity, and international access. Here are some of the most-liked benefits of partaking in crypto poker:

Even though fees can vary by currency, crypto transactions are generally associated with lower fees than credit card transactions or bank transfers. Crypto options like Ripple and Litecoin have consistently low transaction fees, while Bitcoin can incur higher costs during peak times. This makes Ripple and Litecoin ideal for players who make consistent withdrawals and deposits.

Due to the decentralised nature of crypto, players benefit from almost instantaneous transactions across borders. This is particularly useful for international players who would otherwise experience delays with traditional banking transfers. Especially for international transactions, fiat withdrawals can take various business days to reflect. However, crypto transfers are typically processed anywhere from a couple of minutes to a few hours.

Due to regulatory concerns, banks in some countries might restrict transactions through online gambling sites. Using cryptocurrency offers a way to get around these limitations, as players can deposit and withdraw funds directly to and from poker platforms without needing to involve any banking institutions. Players in jurisdictions where traditional poker payment options are restricted might find using cryptocurrency particularly useful in these cases.

Crypto transactions offer a degree of anonymity and discretion, which many online poker players prefer. That’s because crypto transactions do not require any personal financial details from players, unlike traditional payment methods associated with credit card companies or banks. The privacy offered by crypto appeals to players concerned about identity theft and security. Other players prefer the convenience of keeping their gaming activities separate from their other financial dealings.

Some online poker platforms offer exclusive bonuses to players who make crypto deposits to attract more users. These rewards and bonuses might come in the form of free poker tournament entries, extra funds, or rakeback deals (fee rebates taken by the poker site). Sites offering these promotions help add value to the player experience. Additionally, these rewards can sometimes be more generous than deposit bonuses from standard payments.

Despite the many reasons for using crypto for online poker, you still want to know the potential downsides.

It’s common for many online poker platforms to accept Bitcoin. However, fewer platforms allow payments with a broad range of cryptocurrencies. This means that players who prefer using stablecoins or altcoins have limited options. Especially for well-established poker platforms, fiat remains the most popular option, even though the list of crypto-friendly poker sites is growing.

The prices associated with cryptocurrencies are famously volatile. By the time a player withdraws, they might find that their Ethereum or Bitcoin may be worth significantly less (or more) than when they made their initial deposit. Such risks are particularly concerning for players who keep their funds stored on poker sites for extended periods.

Players need to understand transaction confirmations, keys, and wallets when using cryptocurrency. This learning curve may be daunting for players who are new to crypto, just as novice poker players may know the rules but not necessarily in-depth strategies like the art of playing pocket kings or knowing when to bluff. Like using an incompatible network or sending funds to the wrong address, mistakes can lead to permanent loss of funds. Moreover, buying crypto may involve identification verification and fees and requires access to a reliable exchange.

Crypto is subject to scams and hacks if players don’t take the necessary precautions, even though these digital assets offer high levels of security. That’s why players need to use secure platforms and wallets, as these crypto transactions can’t be reversed. Stolen and lost funds can’t typically be recovered, which is unlike credit card transactions in some instances.

Bitcoin is the most accepted and widely used cryptocurrency. However, there are many other altcoins that are popular among poker sites for their unique set of advantages and characteristics. Here’s an in-depth look at some of the most popular crypto coins for poker buy-ins:

Bitcoin maintains its position of being the first and most widely accepted cryptocurrency, which is why it’s the most commonly accepted for online poker. This digital currency is well-liked for widely recognised, fast, and secure transactions. Nonetheless, some users might consider alternative options because of the coin’s slower processing times and higher transaction fees during high-traffic periods.

Pegged to the U.S. dollar, Tether is a stablecoin that offers the flexibility of crypto with the stability of fiat currencies. This is an attractive choice for those wanting to avoid market fluctuations during gameplay, as Tether’s value is less volatile than other cryptocurrencies.

Often labelled as the “silver to Bitcoin’s gold,” Litecoin provides lower transaction fees and faster block generation times. This makes it a practical option for online poker players. This digital asset is widely accepted by poker sites and is a great choice for players wanting a balance between transaction costs and speed.

Another popular option for online poker buy-ins is Ethereum, which is well-liked for its smart contract capabilities. The transaction speeds of ETH are faster than those of Bitcoin, while the Ethereum network also supports various tokens (ERC-20 tokens), which are also accepted on some sites. However, one downfall is that ETH is subject to “gas fees,” which significantly increase during network congestion.

Dogecoin is backed by an active community and is liked for its low transaction fees despite initially being created as a joke. DOGE’s acceptance into specific online poker platforms showcases its appeal to a subset of poker players even though the digital asset is less commonly accepted than ETH or BTC.

Thanks to low costs and rapidly fast transaction speeds, Ripple is an excellent option for players who want to prioritise transaction efficiency. Yet, the somewhat centralised nature of XRP has stirred up debate among crypto enthusiasts.

For those ready to dive into crypto poker, here’s a step-by-step guide to get you started:

You need a crypto wallet to store your cryptocurrencies. When picking a wallet, you can choose between software wallets (desktop, mobile, or online) or hardware wallets (physical store devices). Hardware wallets offer strong security, while software wallets are liked for their added convenience.

Once you’ve set up a wallet, you can go ahead and purchase cryptocurrency on a reliable crypto exchange. Most of these exchanges accept various payment methods, such as credit cards, bank transfers, and even PayPal.

Pick an online poker platform that’s reputable and accepts cryptocurrency. Before deciding on this platform, consider factors like available games, security, user reviews, and withdrawal policies.

After selecting an online poker site, you want to navigate to the platform’s deposit section and choose your preferred cryptocurrency. From here, follow the site’s instructions to fund your account. It’s important to double-check the wallet address to avoid making any errors.

Now that you have funds in your account, you’re ready to join online poker tables and start participating in games. If you’re dealing with a volatile crypto coin, remember to monitor market conditions and practice bankroll management.

Players have several other reliable payment methods for poker buy-ins besides cryptocurrency. Depending on the player’s priorities for convenience, privacy, and speed, each payment method comes with its own set of pros and cons.

Providing a middle-ground solution, e-wallets allow for fast deposits and withdrawals without sharing bank details with the poker platform. Nonetheless, some e-wallets don’t support gambling transactions in various jurisdictions, and transaction fees can vary depending on which e-wallets are accepted.

Typically limited by regional restrictions and incurring fees, debit and credit cards are still one of the most widely accepted payment methods and offer standard transaction speeds. Even though credit or debit card deposits are quick, withdrawals might not be available through this payment method on some poker platforms.

Bank and wire transfers are the most traditional payment methods and are known for being reliable and secure. However, bank or wire transfer transactions are often slow, with withdrawals generally taking up to several working days. Additionally, bank transfers typically incur higher fees, a drawback for frequent online poker players.

A more anonymous method of depositing funds into online poker platforms is through vouchers or prepaid cards. However, such payment methods are limited to deposits only. You can’t typically facilitate withdrawals to prepaid cards. That’s why players require a secondary method if they want to cash out.

Using crypto offers many benefits when playing online poker. However, it also requires players to adopt a responsible and cautious approach. From managing the risks associated with crypto to picking a secure platform or using poker spreadsheets to track your spending, these tips will help players protect their assets and have an enjoyable playing experience.

Your chosen poker platform and wallet can either make or break your playing experience. That’s why you want to pick secure sites that will keep your funds safe. Here’s what to consider:

Acting as the gateway to player funds, cryptocurrency relies on securely storing private keys. That’s why protecting these keys is crucial, and you can do so by:

Between the time you win and cash out, the value of player funds can be significantly impacted by crypto’s volatile price swings. To minimise these risks, you can:

Even though online crypto poker can be convenient and exciting, it’s important to approach playing with the same responsibility as any form of gambling. You can do this by:

The inclusion of cryptocurrency in online poker has opened up new possibilities for players and offered a flexible way to engage in the game. With benefits like faster transactions, improved privacy, easier access across borders, and lower fees, playing poker with crypto is an attractive opportunity for many players who want more control over their online gaming experience.

With that being said, it remains crucial for players to recognise potential drawbacks of using crypto in online poker, especially the security risks associated with digital currency, volatility of crypto assets, and limited availability of crypto poker platforms.

In the end, choosing to play poker with crypto comes down to a player’s comfort with digital assets and preferences. By understanding these pros and cons, staying informed about market trends, and choosing to play on secure platforms, players can empower themselves to partake in rewarding online poker experiences that are improved by the flexibility of cryptocurrency.

Kazakhstan has been making headlines for its stringent approach to regulating cryptocurrencies. By shutting down over 3,500 illegal exchanges, the country is setting an example for the global crypto community. The latest effort by the Kazakh regulator, AFM RK, underscores its commitment to digital asset legislation.

Cryptocurrency use in Kazakhstan has been on the rise, mirroring a global trend. To protect consumers and maintain financial stability, the government has established a comprehensive framework to monitor, supervise, and regulate digital asset activities.

The AFM RK’s recent announcement highlighted the scale of the crackdown. The National Security Committee and the Ministry of Culture and Information collaborated with AFM RK to dismantle illegal exchanges and curb their use in criminal activities, thereby safeguarding the financial system’s integrity.

Kazakh authorities have shut down over 3,500 illegal cryptocurrency exchanges. These platforms, operating without proper licensing and violating the country’s strict digital asset laws, are now banned. This move reduces the risk of financial fraud and money laundering.

In 2024, authorities intensified their efforts by dismantling 36 illegal crypto exchanges with a combined turnover exceeding US$113 million. Assets worth 4.8 million USDT were also frozen and confiscated. Notably, in 2023, Kazakh authorities blocked access to Coinbase for violating the country’s digital asset laws.

The crackdown also uncovered two major cryptocurrency pyramid schemes. Authorities successfully returned 545,000 USDT to victims and froze an additional 120,000 USDT held by the schemes. This recovery effort underscores the government’s commitment to protecting its citizens.

“AFM continues to work with international partners to enhance control over crypto transactions and combat their use for criminal purposes. Amendments to the legislation have also been developed, introducing liability for providers of digital assets in cases of money laundering violations. Checks on cryptocurrency transactions in financial institutions have been strengthened,” stated the regulatory announcement (translated from Russian).

Kazakhstan’s regulatory bodies are working with international partners to enhance control over cryptocurrency transactions. This collaboration aims to prevent the use of virtual assets for criminal purposes, reflecting a broader global initiative.

The regulatory announcement concluded, “AFM will continue to improve tools for effectively monitoring financial transactions to combat criminal schemes involving virtual assets.”

Despite the crackdown on illegal operations, major global crypto exchanges like Bybit and Binance have expanded their presence in Kazakhstan. There are 21 licensed digital asset service providers in the country, including well-known platforms like Binance, Bybit, ATAIX Eurasia, and Biteeu. These companies have obtained full regulatory licenses and demonstrate their dedication to following regulations and working closely with local authorities.

The National Bank of Kazakhstan has launched a pilot programme to explore the digital tenge, a central bank digital currency (CBDC). This initiative aims to modernise financial transactions and enhance processes such as VAT reimbursements through digital fiat.

Currently, crypto exchanges are restricted to operating within the Astana International Financial Centre (AIFC), a trade and financial zone located in Astana. This environment requires a delicate balance between control and innovation for digital asset providers.

Russian authorities have announced that ten regions will halt cryptocurrency mining for six years. The move, starting from January 1, 2025, comes as the country struggles with energy shortages and as part of the country’s strategic financial plans.

The restrictions, lasting till March 15, 2031, is sure to have ripple effects across the crypto world, especially for miners in regions heavily reliant on mining operations. The ban is directed to regions with high energy consumption and demand. The affected regions are Dagestan, Chechnya, and the Donetsk and Lugansk People‘s Republics.

Regions such as Irkutsk and Zabaikalsky will also have specific restrictions during the winter season when electricity demand is at its peak.

The ban comes as Russia struggles with an ongoing energy shortage. This comes as the country usually has high energy demand, especially in colder months. This leads to the country finding it increasingly difficult to manage its power resources effectively, with crypto mining being a significant contributor to this strain due to high consumption.

The has given rise to regional pricing disparities in the country, with some regions having lower electricity prices while others face much higher costs. This has been backed by insights from energy sector experts like Sergey Kolobanov.

Therefore, the government aims to balance energy consumption, address regional pricing disparities, and ensure that the nation’s energy resources are allocated more efficiently. Economic inequalities and inefficiencies are especially prevalent in areas where crypto mining is concentrated.

Vladimir Klimanov, a regional policy specialist, has endorsed the idea of adopting a unified pricing structure across the country. He believes this could reduce the financial strain on certain regions and make energy distribution more sustainable.

While Russia has long allowed cryptocurrency mining, recent changes in the regulatory environment require mining activities to be registered with the Federal Tax Service (FTS). However, small-scale miners, those consuming less than 6000 kWh per month, are exempt from paying for electricity.

The move towards regulation is expected to stabilise the sector and address concerns about unregulated mining activities that cause the already existing energy shortages to exacerbate.

At the same time as the mining ban was announced, Russia’s government has been engaging in discussions about the potential for a Bitcoin Strategic Reserve. This concept proposes that Bitcoin could serve as a safeguard against economic instability.

Bitcoin’s decentralised nature presents it as an attractive alternative to traditional foreign exchange reserves amid inflation and foreign restrictions weighing heavily on Russian economy.

The Bitcoin Strategic Reserve is part of a broader strategy to bolster Russia’s financial stability through the use of digital currencies. With the global economy facing increasing inflation, Russia is looking at ways to diversify its reserves. By adopting Bitcoin, the country could potentially reduce its reliance on traditional financial systems, which are susceptible to international sanctions and political pressures.

Russia has also introduced new laws to regulate the taxation of cryptocurrencies. President Vladimir Putin signed the new law in November 2024, which officially recognise digital assets as property, placing them under legal scrutiny.

By placing them under legal scrutiny, it also makes them subject to taxation, a move that will help regulate and monetise the growing digital asset market.

The introduction of a crypto tax law aligns with Russia’s push toward a more structured and regulated financial landscape. By categorizing digital assets as property, the government hopes to ensure that the cryptocurrency sector contributes to the country’s economy while maintaining transparency and accountability.

Crypto.com has introduced an innovative product that merges sports and cryptocurrency, unveiling its first-ever sports event trading platform exclusively for U.S. users via its application. This platform enables participants to trade predictions on sports event outcomes, with the inaugural offering centred on the upcoming Super Bowl. Users can predict which team will clinch the NFL championship in the app, with various teams listed alongside their probabilities, enabling straightforward selection.

This new platform’s launch, strategically timed ahead of the holiday season, aims to attract an audience and build momentum during a period of heightened consumer engagement. Operating under the oversight of the Commodity Futures Trading Commission (CFTC), Crypto.com adheres to stringent regulatory requirements, ensuring a compliant trading environment for its users, such as UpDown Options and Strike Options.

🏈 Predicting the outcome of The Big Game just got a lot more interesting

Turn correct predictions into profit with Sports Event Trading, now available across the US 🇺🇸

🏆 US$100 payment for each correct event contract you own

✔️ Simple Yes/No decision

🔒 CFTC-regulated… pic.twitter.com/gUaHyycOnf— Crypto.com (@cryptocom) December 23, 2024

Crypto.com co-founder and CEO Kris Marszalek said, “Sports event trading offers an entirely new platform for U.S. users to engage nationwide at Crypto.com and in the Crypto.com app. This unique financial product allows users to trade their prediction on the outcome of a sports event. It’s a fundamentally new concept for sports, and we’re thrilled to be the first regulated platform in the U.S. to offer it to our users.”

Gaming industry analyst Chris Grove published a post highlighting its significance, suggesting it should capture the attention of stakeholders in the U.S. regulated online betting market. Grove posted, “This news should be rocketing through the inbox or chat app of every analyst, every C-suite, every investor, and every stakeholder with an interest in the U.S. regulated online betting market.”

PlayerProps.ai Founder and CEO Trevis Waters stated, “All 50 states are crazy. Just not sure if that’s a ‘crazy good’ or a ‘crazy bad’ yet.”

ClutchBet’s technology expert David Belovitch hinted at the possibility of regulatory backlash. He added, “They can call it what they like but it is sports betting. Rogue cowboy stuff.”

Crypto betting hasn’t gained much traction in the U.S. sports betting scene, making Crypto.com’s offering quite unique. Like sweepstakes casinos, which are still hotly debated, this new development is expected to spark further discussions about the legality and classification of online gaming activities.

The company’s new project comes amid efforts to make crypto a more attractive payment method for consumers as the sector hits record highs, with bitcoin, the most popular cryptocurrency, topping $108,000 last week. As crypto adoption grows, remaining abreast of regulatory changes is also something that could be vital for consumers and merchants.

US President-elect Donald Trump met with Crypto.com chief executive officer (CEO) Kris Marszalek the same day the company dropped its lawsuit against the US Securities and Exchange Commission (SEC).

Marszalek flew down to meet Trump at his residence in Mar-a-Lago to discuss policies potentially affecting the crypto industry. Crypto.com CEO and Trump held discussions surrounding the US President-elect’s proposal to launch a national Bitcoin reserve. In addition, they also discussed appointments in Trump’s administration related to the crypto industry.

The meeting coincided with Singapore-based crypto trading platform Crypto.com dropping its lawsuit against the US SEC. A court filing shows the crypto exchange has voluntarily dismissed its suit against the SEC and its commissioners with prejudice.

Marszalek shared a still on X from his meeting with Trump.

A company’s spokesperson said the firm withdrew the lawsuit owing to its “intent to work with the incoming administration on a regulatory framework for the industry.”

Crypto.com filed a lawsuit against the US Securities and Exchange Commission (SEC). The platform alleged that the agency is overstepping its jurisdiction by regulating the crypto industry.

This comes after the trading platform received a ‘Wells notice’ from the top US markets regulator, signalling the SEC’s intention to take enforcement against the company on grounds that tokens traded on its platform qualified as securities. Marszalek said in October that Crypto.com would be filing a suit against the SEC “to protect the future of crypto.”

A Wells notice is a formal announcement that signals that the SEC is planning to bring an enforcement action against a company.

Crypto.com alleged in the lawsuit that the US SEC is expanding its jurisdiction beyond legal limits and is continuing with an unauthorised and unfair regulatory campaign.

Crypto.com in a statement, said, “Our lawsuit contends that the SEC has unilaterally expanded its jurisdiction beyond statutory limits and separately that the SEC has established an unlawful rule that trades in nearly all crypto assets are securities transactions.”

The crypto trading platform’s CEO Kris Marszalek said on X (formerly Twitter), “This unprecedented action by our company against a federal agency is a warranted response to the SEC’s regulation by enforcement regime which has hurt more than 50 million American crypto holders.”

In another post, he said, “The SEC’s unauthorized overreach and unlawful rulemaking regarding crypto must stop.”

The Singapore-based platform has filed the case in Texas’ Tyler federal court, which names SEC Chair Gary Gensler and four more commissioners as defendants. Moreover, the company has filed a separate petition with the Commodity Futures Trading Commission (CFTC) and the SEC. This petition seeks to confirm exclusive regulation by the CFTC of certain crypto derivative products.

Metaverse casinos combine virtual reality (VR), cryptocurrency, and web3 technology to create a life-like and immersive online gambling experience. Gamblers no longer need to travel to Las Vegas to experience the thrill of in-person table and slot games; the Vegas experience can now be convincingly recreated in their living room.

However, this concept is only in its infancy and hasn’t yet been widely adopted. For it to become popular in the UK, casinos based in the country would first have to start accepting cryptocurrency. Kane Pepi, who writes expert ratings for non-Gamstop casinos, states that crypto banking is not currently offered by any casino regulated by the UK Gambling Commission (UKGC). He also claims that this fact is unlikely to change in the future.

On the other hand, non-Gamstop casinos – i.e., casinos that can be used while a player is signed up for the Gamstop self-exclusion programme – already widely accept cryptocurrencies. These sites operate offshore, meaning they don’t need to abide by UKGC regulations, which is why they’ve been quicker in adopting crypto. Will offshore casinos bring metaverse casinos into the mainstream?

Metaverse casinos are virtual gambling facilities found in metaverse worlds such as Sandbox and Decentraland. Plots of land within these worlds have recently been bought by online casinos with the intent of constructing virtual casinos. When you put on a VR helmet and enter the Sandbox, you can visit these virtual casinos. VR and augmented reality combine to give you a realistic impression of entering a brick-and-mortar casino.

Once you enter, you can explore the casino’s interior, just as you would in real life. You can walk past the casino’s selection of slot and table games, interact with other visitors, and generally soak up the casino atmosphere.

As metaverse casinos develop, virtual entertainment events will likely be held within them – just as brick-and-mortar casinos provide live entertainment.

Metaverse casinos are an exciting new concept and will likely increase the popularity of online casinos. Already, physical casinos are struggling to compete with the convenience of casino apps. Metaverse casinos come with a whole host of other benefits, which include the following:

In the metaverse, everything is digitised – including the currency. In these virtual casinos, players deposit and withdraw funds using crypto. They also receive bonuses – such as sign-up bonuses and deposit bonuses – in the form of crypto. Cryptocurrency is the preferred transaction of metaverse casinos due to the quick transaction processes, transparency, and convenience offered.

Each transaction completed in metaverse casinos is done through blockchain technology and smart contracts. This ensures that each transaction is transparent and encrypted. All exchanges are recorded on the blockchain, meaning that all exchanges are immutable. Plus, players don’t have to enter their bank details or personal information, meaning that hackers have nothing to steal should they infiltrate the system.

Within the virtual casino, gamers can walk right up to other players and interact with them. This creates a convincingly life-like casino experience. While standard online casinos come with chat rooms, they are incomparable to the socialisation opportunities found in metaverse casinos.

As mentioned above, metaverse casinos haven’t yet taken off. This is partially because mainstream online casinos have yet to accept crypto as a payment means. For metaverse casinos to work, cryptocurrency is needed for deposits and withdrawals. UK-based casinos would have to first start accepting Bitcoin and Ethereum before offering metaverse functionality.

However, as non-Gamstop and other offshore casinos become more popular, crypto gambling and metaverse casinos will become more widespread as a result.

Another aspect that’s holding metaverse casinos back is the limited adoption of VR. When they were first released, VR helmets were expensive and out of most iGamers’ budget. As the years have passed, helmets have gradually fallen in price. Soon, they’ll be more affordable, which won’t only boost metaverse gambling but also metaverse gaming at large.

The VR headset market is expected to grow at a CAGR of 30.6 percent between 2023 and 2030. This suggests that they’re expected to become more popular in the coming years.

Once the above conditions are met, metaverse casinos could well take over as the leading casino option for gamblers.

On June 11, 2024, Australia enacted a ban on the use of cryptocurrency and credit cards for online gambling, as part of the amendments to the Interactive Gambling Amendment Bill 2023. This new regulation has sparked concerns within the industry regarding its potential effects on both domestic and offshore online casinos.

The Australian gambling industry has recently experienced a wave of significant reforms. One of the first major changes was the introduction of mandatory pre-verification for all customers on online gambling platforms. Additionally, the government has replaced the familiar “Gamble Responsibly” slogan in betting ads with more impactful, evidence-based warnings designed to better address the risks of gambling. In August 2023, the government launched the BetStop initiative, a nationwide self-exclusion registry aimed at protecting vulnerable individuals from gambling harm. Currently, lawmakers are also considering a potential ban on gambling advertising.

The ban on using cryptocurrency and credit cards for online gambling is part of this broader strategy aimed at preventing individuals from wagering money they do not possess, thereby mitigating the risk of financial harm.

Minister for Social Services Amanda Rishworth highlighted that this nationwide ban represents a critical measure in addressing the adverse effects of online gambling. By enforcing these regulations, Australians are restricted to gambling only with funds they already have. “As a result, minimum deposit online casinos have become more appealing, given that they accept initial deposits as low as $1,” explained GambleOnlineAustralia.com.

However, the ban on credit card and cryptocurrency payments does not apply to online lotteries and keno, creating inconsistencies in consumer protection across different forms of gambling. Kai Cantwell, CEO of Responsible Wagering Australia, expressed concerns that the exemption might drive players toward less-regulated gambling options, undermining the government’s efforts to control the industry.

The government provided a six-month transition period for operators to adapt to the new regulations, with the Communications Regulatory Authority overseeing the implementation. Companies that fail to comply with the ban face fines of up to $157.000.

The ban does not extend to offshore online casinos, which are beyond the reach of Australian regulation. With the global rise of cryptocurrencies and the decline of the US dollar, many countries have increasingly accepted cryptocurrencies as a payment method. This includes nations such as the United States, the United Kingdom, Canada, Norway, and New Zealand, all of which permit the use of cryptocurrencies in online gambling.

In the United States, cryptocurrencies are legal and widely accepted by businesses for various transactions. However, their use in online gambling is subject to state-specific regulations. Additionally, many offshore cryptocurrency casinos operating in the US lack Know Your Customer (KYC) protocols, resulting in anonymous transactions.

In contrast, the United Kingdom has a well-regulated gambling market that permits the use of cryptocurrencies. The UK Gambling Commission (UKGC) mandates that all cryptocurrency casinos adhere to KYC requirements for their customers. Furthermore, the UKGC ensures that all licensed operators incorporate anti-money laundering provisions into their terms and conditions.

While Australia imposes strict rules on domestic online gambling, Australian players can still use cryptocurrencies to gamble at offshore casinos, as the ban only applies to platforms registered within Australia.

The ban on cryptocurrency and credit card payments has ignited debate among stakeholders in the gambling industry. Critics argue that the ban could lead to several significant consequences for the sector:

– Reduced access and convenience: The ban may force players to switch to traditional banking methods, potentially reducing their access to and convenience of gambling.

– Shift to unregulated platforms: Australian players who find the ban restrictive may turn to unregulated or offshore casinos, which could expose them to higher security and financial risks.

– Decreased competitiveness and innovation: The ban could hinder the development of the gambling industry in Australia, putting local operators at a disadvantage and limiting their investment in new payment and gaming technologies.

Despite this ban, Australia remains a crypto-friendly country. According to Statista, 25.6% of Australians own cryptocurrency, placing the country ninth globally in crypto adoption.

Cryptocurrencies have revolutionized the online casino industry, offering unique advantages like enhanced privacy, security, and swift transactions. As the popularity of crypto casinos continues to rise, understanding the key terms and concepts is essential for both new and experienced players. This comprehensive cryptpo casino glossary covers the 30 most popular crypto casino terms, helping you navigate this dynamic world with ease.

A cryptocurrency is a digital or virtual currency that uses cryptography for security. It operates on decentralized networks based on blockchain technology. Popular cryptocurrencies used in casinos include Bitcoin, Ethereum, and Litecoin.

Blockchain is a distributed ledger technology that records all transactions across a network of computers. It ensures transparency and security, making it a critical component of crypto casino platforms.

Bitcoin is the first and most well-known cryptocurrency. It is commonly used in crypto casinos due to its high liquidity and widespread acceptance.

Ethereum is a decentralized platform that enables the creation of smart contracts and decentralized applications (dApps). Its native cryptocurrency, Ether, is widely used in crypto casinos for its quick transaction times and smart contract functionalities.

A smart contract is a self-executing contract with the terms of the agreement directly written into code. In crypto casinos, smart contracts automate payouts, ensure fairness, and eliminate the need for intermediaries.

A decentralized application, or dApp, runs on a blockchain network rather than a centralized server. In crypto casinos, dApps provide transparent and fair gaming experiences.

A token is a type of cryptocurrency that represents an asset or utility on a particular platform. In crypto casinos, tokens can be used for betting, earning rewards, or participating in platform governance.

A coin is a cryptocurrency that operates on its own independent blockchain. Examples include Bitcoin and Ether, which are commonly used in crypto casinos.

A crypto wallet is a digital tool that allows users to store, send, and receive cryptocurrencies. It is essential for managing funds in crypto casinos.

A hot wallet is a type of crypto wallet connected to the internet. While convenient for frequent transactions, it is more vulnerable to hacking.

A cold wallet is a type of crypto wallet that is not connected to the internet, offering enhanced security for long-term storage of cryptocurrencies.

A transaction in crypto casinos refers to the transfer of cryptocurrency from one wallet to another. Transactions are recorded on the blockchain, ensuring transparency and security.

A miner is a participant in a blockchain network who uses computational power to validate transactions and add new blocks to the blockchain. Miners are rewarded with cryptocurrency for their efforts.

A consensus mechanism is a protocol used to validate transactions and maintain the integrity of the blockchain. The most common mechanisms are Proof of Work (PoW) and Proof of Stake (PoS).

Proof of Work is a consensus mechanism where miners solve complex mathematical problems to validate transactions and add new blocks to the blockchain. Bitcoin uses PoW, providing a high level of security for transactions.

Proof of Stake is a consensus mechanism where validators stake a certain amount of cryptocurrency to validate transactions and create new blocks. PoS is more energy-efficient than PoW and is used by several newer cryptocurrencies.

A gas fee is a small amount paid to miners or validators for processing and verifying transactions on the blockchain. Higher fees can prioritize transactions, ensuring they are confirmed faster.

A private key is a secret code that allows users to access and manage their cryptocurrencies. It is crucial to keep private keys secure, as anyone with access to the private key can control the associated funds.

A public key is a cryptographic code that allows users to receive cryptocurrencies. It is paired with a private key but does not reveal any private information.

Decentralized Finance, or DeFi, refers to financial services built on blockchain technology that operate without a central authority. DeFi applications include lending, borrowing, trading, and earning interest on crypto assets.

A gaming dApp is a decentralized application specifically designed for gaming. These dApps provide fair and transparent gaming experiences by leveraging blockchain technology.

A Bitcoin casino is an online casino platform that primarily accepts Bitcoin for deposits and withdrawals. These casinos offer various games and are popular due to Bitcoin’s widespread acceptance and liquidity.

A crypto casino is an online casino platform that accepts multiple cryptocurrencies for deposits and withdrawals, offering a wide range of games like poker, slots, and sports betting.

Betting odds represent the likelihood of a specific outcome in a casino event. They are expressed in various formats, including decimal, fractional, and American.

The house edge is the mathematical advantage that the casino has over players, ensuring the casino’s profitability over time. It is expressed as a percentage of each bet that the casino expects to keep.

RTP stands for Return to Player, a percentage that indicates how much of the wagered money a game returns to players over time. Higher RTP percentages are more favorable for players.

A jackpot is a large prize that accumulates over time and is awarded to a lucky player. In crypto casinos, jackpots can be significantly larger due to the global nature of cryptocurrency transactions.

Free spins are complimentary spins on a slot game, often given as a promotion or reward. They allow players to win without risking their own money.

Provably fair is a system that allows users to verify the fairness of a game’s outcome using cryptographic algorithms. In crypto casinos, this system ensures that the outcomes of games are not manipulated and are genuinely random. Players can independently verify the integrity of each game result, which builds trust and transparency.

A faucet is a reward system in crypto casinos where users can earn small amounts of cryptocurrency for free, often by completing simple tasks or activities. Faucets are used to attract new users and provide them with an introduction to the platform. The rewards are usually small but can accumulate over time. Faucets offer a risk-free way for players to start their crypto casino journey and explore different games.

A bet is an amount of cryptocurrency wagered on a particular outcome in a casino game. Bets can be placed on various types of games, including sports events, casino games, and more. In crypto casinos, placing a bet involves transferring a specific amount of cryptocurrency to the platform, with potential returns based on the odds and the outcome. Understanding betting mechanics is crucial for managing your bankroll and making informed decisions.

Odds represent the probability of a particular outcome occurring in a casino game. They influence the potential payout and are expressed in various formats, such as fractional, decimal, or moneyline. In crypto casinos, understanding odds is essential for making informed bets and maximizing potential returns. Odds can vary between platforms and games, so players should compare and choose the best options for their strategies.

A payout is the amount of cryptocurrency a player receives after winning a bet in a casino game. Payouts are determined by the odds and the amount wagered. In crypto casinos, payouts are often processed quickly and directly to the player’s crypto wallet, leveraging blockchain technology for fast and secure transactions.

A Random Number Generator (RNG) is a system used to ensure the outcomes of casino games are random and fair. In crypto casinos, RNGs are often integrated with blockchain technology to create provably fair systems, where players can verify the randomness and fairness of game outcomes.

A wagering requirement is a condition that requires players to bet a certain amount before they can withdraw their winnings from a bonus. These requirements are common in online casino promotions, ensuring that players engage with the platform before cashing out. In crypto casinos, understanding and meeting wagering requirements is crucial for maximizing the value of bonuses and avoiding forfeiture of winnings.

A bonus is a reward offered by crypto casino platforms to attract and retain players. Bonuses can come in various forms, such as free cryptocurrency, free spins, deposit matches, and more. They provide extra value and encourage players to try new games or deposit more funds.

Roll over refers to the process of reinvesting winnings from a bet into subsequent bets. This strategy is commonly used in casinos to increase potential returns by compounding winnings. In crypto casinos, rolling over can be part of a betting system or strategy aimed at maximizing profits.

A card game where players aim to have a hand value closest to 21 without exceeding it, commonly played in crypto casinos.

Know Your Customer is a regulatory requirement for financial institutions and crypto exchanges to verify the identity of their users. KYC helps prevent fraud, money laundering, and other illegal activities.

AML stands for Anti-Money Laundering, a set of laws and regulations designed to prevent money laundering activities. Crypto casino platforms often implement AML procedures to ensure compliance with regulatory standards.

Understanding the terminology is crucial for navigating the world of crypto casinos. This glossary has covered the 30 most popular terms, providing a solid foundation for both new and experienced players. With this knowledge, you’ll be better equipped to explore and enjoy the benefits of crypto casinos.