- SUMMITS

- NEWS & MEDIA

- SUMMITS

- NEWS & MEDIA

India is moving closer to introducing a central bank-backed digital currency (CBDC), designed to simplify transactions, reduce paper use, and offer faster, traceable payments built on blockchain technology

According to several media reports, Piyush Goyal, the minister of commerce, has announced that India will soon introduce a digital currency that is insured by the Reserve Bank of India (RBI).

“We will be coming out with a digital currency backed by the RBI guarantee. It will be like normal currency—somewhat like the stablecoins that the USA has announced,” Goyal said during a recent roundtable in Qatar.

He added that the new system will not only speed up transactions and cut paper usage but also ensure traceability through blockchain, making it easier to track and prevent illegal activities. The remarks follow Finance Minister Nirmala Sitharaman’s comments that stablecoins are rapidly transforming global finance and that countries must adapt or risk being left behind.

According to Goyal, the proposed digital currency will coexist with India’s CBDC, known as the e-rupee. The RBI launched its first CBDC pilot for wholesale transactions in November 2022, involving nine major banks including State Bank of India, HDFC Bank, ICICI Bank, and HSBC. A retail version followed in December 2022, allowing consumers to use a digital wallet via participating banks.

As of 2025, India counts over seven million CBDC users, with the RBI focusing on real-world use cases rather than a full-scale rollout. RBI Deputy Governor T. Rabi Sankar said the goal is to create programmable CBDC applications that allow users to set custom conditions for spending.

“A user should be able to attach a program to the CBDC and then use it without needing to understand the technology,” Sankar explained during the Global Fintech Fest 2025. He added that cross-border payments remain the key long-term application for CBDCs.

The RBI is now preparing a pilot project on deposit tokenisation, leveraging the wholesale version of its CBDC as a foundational layer. According to Reuters, the central bank is collaborating with select lenders to test this innovation.

RBI Chief General Manager Suvendu Pati explained: “Risks in asset tokenisation are manageable and can be addressed through regulatory guardrails.”

Tokenisation converts financial assets such as deposits, bonds, or equities into digital formats recorded on blockchain, enhancing security and transaction speed while lowering costs.

The RBI’s January 2025 Payment System Report also revealed significant progress in card tokenisation, with over 910 million tokens created by December 2024 and more than 3.2 billion transactions processed since its launch.

While India is embracing blockchain-based financial systems, it continues to discourage decentralised cryptocurrency trading. Goyal reiterated that India’s approach is to regulate, not ban, crypto assets, but also to ensure they remain outside the definition of legal tender.

“There’s no ban on cryptocurrency, but we tax it heavily. We don’t encourage it because there’s no sovereign backing,” Goyal said. “You can use it at your own risk and cost—the government neither encourages nor discourages, it only taxes.”

India levies a GST of 18 percent on trades, a 1 percent TDS on transactions over ₹10,000 ($112), and a 30 percent flat tax on cryptocurrency gains. A number of smaller businesses are anticipated to close or merge in 2025 as a result of the consolidation of Indian cryptocurrency exchanges brought about by regulatory pressure and the absence of official legislation pertaining to digital assets.

In separate news, according to the sixth Chainalysis Global Crypto Adoption Index, India ranked first in cryptocurrency adoption for 2025. The United States comes in second, indicating a rise in activity in both nations. The research shows, market trends are being influenced by institutional investment and grassroots usage. India leads in all measured categories, including retail and institutional flows. The US rise is linked to higher institutional involvement following the approval of spot bitcoin ETFs. Pakistan, Vietnam, and Brazil complete the top five.

Meanwhile, India’s cryptocurrency market has expanded rapidly, leading to increased attention from tax authorities. In August, the Income Tax Department issued over 44,000 notices to individuals who failed to report Virtual Digital Asset (VDA) transactions in their income tax returns. This forms part of a broader initiative to ensure compliance and bring crypto-related earnings within the tax framework.

Bitcoin fell 8.4 percent to $104,782 following heightened tensions in the US-China trade conflict. The decline came after US President Donald Trump announced a 100 percent tariff on Chinese tech exports and new export restrictions on key software. The announcement triggered a sharp reaction across global financial markets, leading to significant losses in cryptocurrency value.

Bitcoin had a precipitous plunge following the announcement of higher tariffs, which led to a general market slump. With notable losses in key assets like Ethereum, BNB, and XRP, the cryptocurrency industry saw a value decline of almost $19 billion.

Trump called China’s export restrictions on rare earths excessively harsh in his statement on Truth Social. He responded by tightening export restrictions on vital software and levying 100 percent tariffs on Chinese tech exports. Global market financial instability increased as a result of the announcement.

Coinglass reported that 1.6 million traders were liquidated within 24 hours, with over $7 billion in positions sold in less than an hour. The rapid sell-off intensified market losses. Exchanges such as Binance experienced high liquidation volumes, and analysts estimate total liquidations could surpass $30 billion.

In less than an hour, Bitcoin fell from about $113,000 to $102,000 before levelling off at about $104,782. This was the sharpest drop since 2020. Selling pressure persisted even if the $102,000 support level momentarily held. Price volatility has usually resulted from such steep declines.

Ethereum declined 5.8 percent to $3,637, BNB dropped 6.6 percent to $1,094.09, and XRP fell 22.85 percent to $2.33, reducing its market capitalisation by over $140 billion. Tether decreased slightly by 0.1 percent, indicating cautious investor sentiment across the crypto market.

Cryptocurrencies, being relatively new and decentralised, are highly responsive to geopolitical developments. Events like trade disputes, tariff changes, and political instability often lead to investor uncertainty and widespread selling.

The recent tariff measures are part of ongoing trade disputes between the US and China. Rare earth minerals, essential for electronics and clean energy, are now central to the conflict. The new tariffs reflect the growing link between geopolitical decisions and financial markets.

The S&P 500 declined over 2 percent as investors moved towards safer assets like bonds and the US dollar. The policy shift in Washington triggered volatility across global financial markets.

Edul Patel of Mudrex noted that despite the correction, sentiment remains optimistic, citing past October recoveries averaging 21%. Brian Strugats from Multicoin Capital cautioned that counterparty risks could lead to broader financial instability.

Patel said, “The crypto market is reacting strongly to Trump’s announcement of a 100 percent tariff on China, with a total market cap standing at $3.74 trillion. Bitcoin briefly tested $102,000 levels before recovering to the $113,000 range. Historically, October corrections (as seen between 2017 and 2022) have often been followed by relief rallies of up to 21 percent. Despite the short-term selling pressure, overall sentiment remains bullish.”

Some analysts view the current decline as a potential entry point, contingent on Bitcoin holding key support levels. Others warn that if financial stress spreads, the downturn could persist.

Investors from institutions are keeping an eye on possible capital movements from gold to cryptocurrency. In the event of short-term market turbulence, anticipated approvals of US spot altcoin ETFs could provide liquidity and aid in market stabilisation. In order to control risk, investors are concentrating on structured approaches like dollar-cost averaging. During times of market volatility, careful position sizing and strict risk management are essential.

In the past, October has seen corrections in Bitcoin followed by periods of rebound. Investors had opportunities during these bounces, which averaged about 21 percent between 2017 and 2022. Global political issues are having an increasing impact on cryptocurrency markets. Decisions by major economies can trigger widespread market reactions, highlighting crypto’s growing integration with global financial systems.

North Korean hackers have stolen more than $2 billion worth of cryptocurrency so far in 2025, their most profitable year on record, according to a new report by blockchain analytics firm Elliptic.

The thefts, which researchers say now make up around 13 percent of North Korea’s total gross domestic product (GDP), highlight a growing shift in strategy by regime-linked hacking groups such as Lazarus Group. Rather than focusing exclusively on cryptocurrency exchanges, hackers are increasingly targeting high-net-worth crypto holders, many of whom lack the robust cybersecurity measures used by large organisations.

“Other thefts are likely unreported and remain unknown as attributing cyber thefts to North Korea is not an exact science,” Dr. Tom Robinson, Chief Scientist at Elliptic was quoted as saying by BBC. “We are aware of many other thefts that share some of the hallmarks of North Korea-linked activity but lack sufficient evidence to be definitively attributed.”

The report warns that private investors, often holding millions in personal wallets, have become lucrative and vulnerable marks for North Korean hackers. Attacks on individuals are also less likely to be disclosed, meaning the actual figure could be even higher than Elliptic’s $2 billion estimate.

According to Elliptic, 2025’s cyber theft spree has already eclipsed North Korea’s previous record of $1.35 billion in 2022, bringing the total cumulative stolen crypto to over $6 billion since the country’s cybercrime operations began.

The single largest attack this year came in February, when hackers stole $1.4 billion from the crypto exchange Dubai-based cryptocurrency exchange ByBit. The heist was pulled off by North Korean group hackers. Other incidents include a $14 million theft from nine WOO X users in July and a $1.2 million breach at Seedify. Elliptic also confirmed that several unnamed organisations and individuals lost tens or even hundreds of millions in separate attacks. The largest individual theft so far this year amounted to $100 million.

Western intelligence agencies believe that the proceeds from these cyber heists are being funneled into North Korea’s nuclear weapons and missile development programs, helping the regime sidestep international sanctions.

Elliptic and other blockchain analytics companies like Chainalysis have been instrumental in tracking the stolen funds, using blockchain forensics to trace the flow of Bitcoin, Ethereum, and other digital assets through the public ledger.

Despite mounting evidence, North Korea has consistently denied any involvement in cyberattacks. The country’s UK embassy did not respond to requests for comment.

In addition to its prolific hacking campaigns, the North Korean regime is also accused of running a fake IT worker network to earn hard currency abroad. This is to further bypass global sanctions and boosting its covert income streams.

The UN estimates that North Korea’s GDP in 2024 was $15.17 billion, meaning that the regime’s cryptocurrency thefts, estimated at $2 billion in 2025 alone, could represent a significant share of its national revenue.

As the sophistication of North Korean cybercrime operations grows, experts warn that crypto investors must strengthen their own defenses, especially those holding large digital asset portfolios outside of institutional protection.

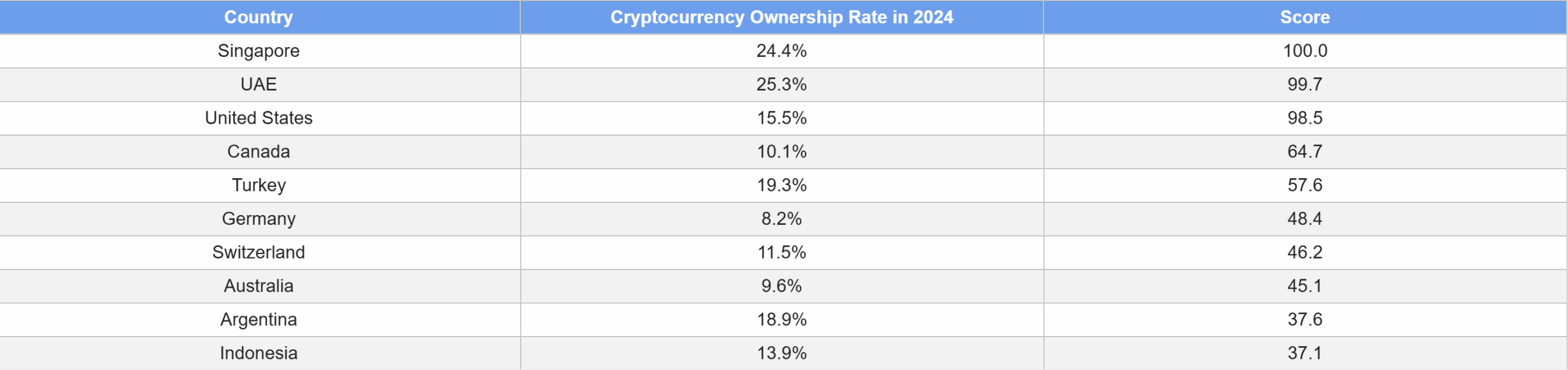

Cryptocurrency is a part of digital finance, used in transactions and institutional investments. A report by ApeX Protocol lists Singapore and the United Arab Emirates (UAE) as the leading countries in cryptocurrency activity. The data reflects adoption levels and the role of digital assets in their financial systems and societies.

With a composite score of 100, Singapore is the country with the highest adoption of cryptocurrencies worldwide, as reported by several media outlets. The percentage of residents with digital assets rose from 11 percent to 24.4 percent between 2021 and 2022. With almost 2,000 searches per 100,000 individuals, the nation also has the highest number of online searches pertaining to cryptocurrencies.

The Monetary Authority of Singapore (MAS) regulates exchanges and digital payment providers. The regulatory structure is intended to safeguard consumers while fostering innovation. The fact that cryptocurrency is utilised in a number of industries, such as retail and financial services, suggests that it is present in daily transactions.

The United Arab Emirates ranks just behind Singapore in cryptocurrency engagement, with a composite score of 99.7. Approximately 25.3 percent of the population owns digital assets, the highest recorded rate globally. Since 2019, ownership has increased by 210 percent, peaking in 2022 before stabilising.

Dubai hosts exchanges, industry events, and blockchain-related organisations. Regulatory structures such as the Virtual Assets Regulatory Authority (VARA) provide operational guidelines for businesses. The UAE offers tax arrangements, designated business zones, and policies that support blockchain-related activities.

Summary of ApeX’s report. Source ApeX

The United States ranks third globally in cryptocurrency engagement, with a composite score of 98.5, primarily due to its infrastructure. It has over 30,000 cryptocurrency ATMs, significantly more than any other country.

Since 2019, usage has increased by 220 percent, although ownership rates remain comparatively lower. Developments such as spot Bitcoin ETFs and institutional involvement have contributed to broader market participation. Retail investors have also played a role in increasing the use of cryptocurrency in financial activities.

Canada ranks fourth in global cryptocurrency engagement, with a composite score of 64.7. Since 2019, adoption has increased by 225 percent, the highest growth rate among the countries listed. There are approximately 3,500 cryptocurrency ATMs across the country, contributing to widespread access. Ownership stands at 10.1 percent, showing gradual growth compared to other leading nations.

Turkey ranks fifth in global cryptocurrency engagement, with a composite score of 57.6. Approximately 20 percent of the population owns digital assets. Online search activity related to cryptocurrency is high, with around 1,000 searches per 100,000 people. Economic factors, including currency inflation, have contributed to increased interest in digital assets.

Germany is known for having clear financial regulations, and Switzerland has banks that accept digital assets. Blockchain technology is incorporated into Australia’s digital infrastructure, and in Argentina, bitcoin adoption has increased in response to inflation. Adoption among younger users is increasing in Indonesia.

According to the ApeX Protocol study, four indicators were used to assess global trends: ownership rates, ATM availability, adoption growth since 2019, and search activity. The UAE and Turkey lead in ownership, while the United States has the most extensive ATM network. Canada recorded the highest growth in adoption, followed by the US and the UAE. Singapore ranks highest in search volume, with Turkey and Indonesia also showing significant online interest.

In contrast to the ApeX rankings, the Chainalysis Adoption Index offers a distinct perspective. For three years running, India has led the world in the adoption of cryptocurrencies, mostly because of its large retail user base. Thanks to regulatory changes and a rise in ETF activity, the US has risen to second place. With considerable development in nations like Vietnam and Pakistan, the Asia-Pacific region leads in transaction volume. Singapore stands out for its strong institutional interest and progressive regulatory environment, further solidifying its role as a regional crypto hub.

US President Donald Trump-backed World Liberty Financial (WLFI) has announced plans to roll out a debit card that integrates with Apple Pay. The move is aimed at facilitating seamless retail transactions for USD1, the decentralised finance (DeFi) project’s native stablecoin. Additionally, it will also expand the project’s reach into mainstream payment solutions.

The announcement was made by WLFI co-founder Zak Folkman during Korea Blockchain Week 2025 in Seoul. Folkman described the debit card as a key part of WLFI’s retail application, which will launch in the near future.

“It allows users to be able to attach their USD1 and their World Liberty Financial app right into their Apple Pay. Not today, but it’s coming very soon,” Folkman told the audience.

The WLFI debit card will be complemented by the project’s upcoming retail application. As quoted by media, Folkman said the app will operate as a cross between “Venmo and Robinhood,” combining trading capabilities with Web2-style peer-to-peer payments. The WLFI platform will provide investment tools and accessibility through a single interface.

By targeting everyday retail use cases alongside crypto-native functions, WLFI is positioning itself as a bridge between traditional finance and decentralised finance.

Folkman also used the stage to dismiss speculation that World Liberty Financial might build its own blockchain. Instead, he stressed that the project will remain chain-agnostic, focusing on interoperability and broad adoption.

“We will never put out a World Liberty Financial chain. It’s literally the opposite of our entire mentality. We believe our job is not to roll out chains or exchanges, but to be completely agnostic when it comes to chains, technology, and distribution platforms,” he said.

WLFI’s native cryptocurrency has been under pressure since its launch on 1 September 2025. The token, which has hovered around $0.20, is trading 35 percent down from its debut.

Market analysts have highlighted several key levels for WLFI. Popular crypto analyst CryptoBusy noted that the token slipped below its ascending trendline, signalling weakening momentum. Accumulation zones have been identified at $0.2088, $0.1973, and $0.1855, while a breakout above $0.2399 on strong volume could flip WLFI back into a bullish structure.

Earlier this month, WLFI burned 47 million tokens in an effort to stabilise its market performance, but selling pressure has persisted.

Folkman acknowledged the volatility, stating that WLFI will remain exposed to market fluctuations. However, he emphasised confidence in long-term growth as the project expands its ecosystem of products.

In separate news, World Liberty Financial has also signed a memorandum of understanding (MoU) with South Korean exchange Bithumb. The collaboration is expected to strengthen WLFI’s presence in the Asian market, where crypto adoption continues to accelerate.

With its debit card, retail app, and Apple Pay integration in the pipeline, WLFI is betting on mainstream usability to drive adoption of its USD1 stablecoin and associated ecosystem.

In March, WLFI raised a further $250 million from its second token sale. The total amount raised stood at $550 million. WLFI is closely related to the Trump family and is touted as a revolutionary decentralised finance banking platform. The company sold $300 and $250 million worth of Ethereum, Bitcoin, Tron, Ondo, Sui, and other cryptocurrencies in two sets of token sales. The announcement by WLFI stated that more than 85,000 people completed Know Your Customer (KYC) verifications to participate in the sale, indicating widespread interest from across the crypto spectrum.

Standard Chartered’s venture capital arm, SC Ventures, is reportedly preparing to launch a $250 million digital asset investment fund in 2026. According to a report by Bloomberg, the fund will focus on digital assets within the financial services industry. SC Ventures Operating Partner Gautam Jain confirmed that the fund will be backed by Middle Eastern investors and will target global opportunities across the sector.

The initiative reflects the rising appetite among corporate and institutional investors to gain structured exposure to digital assets. In recent years, several corporate treasury firms have adopted long-term accumulation strategies, suggesting broader institutional inflows may accelerate in the coming years.

SC Ventures has not yet disclosed which specific cryptocurrencies or blockchain-based assets will form part of the fund. Requests for comment on the fund’s crypto allocations were not immediately answered.

Beyond the digital asset initiative, SC Ventures is also preparing to roll out a $100 million Africa-focused investment fund. Jain noted that the firm is considering its first venture debt fund as well, though it remains unclear whether these additional vehicles will have a crypto or fintech emphasis.

The new funds are part of SC Ventures’ strategy to diversify its portfolio into emerging markets and digital infrastructure. This will help position Standard Chartered as an active player in both fintech innovation and frontier investment landscapes.

The announcement comes against a backdrop of market pressure on digital asset treasuries (DATs). Standard Chartered recently raised concerns about the declining market net asset value (mNAV) of DAT firms—a key metric comparing enterprise value to cryptocurrency holdings.

Several prominent treasury firms have slipped below the critical 1.0 mNAV threshold, indicating difficulties in issuing new shares and sustaining crypto accumulation.

“The recent collapse in DAT mNAVs will likely drive differentiation and market consolidation,” Standard Chartered said in a recent note. The bank added that stronger firms with access to low-cost capital and staking yields would be better positioned, naming industry leaders such as Strategy and Bitmine as examples.

The $250 million SC Ventures fund adds to a series of institutional announcements expanding exposure to cryptocurrencies beyond Bitcoin. On the same day, Nasdaq-listed Helius Medical Technologies revealed plans to establish a $500 million corporate treasury reserve using Solana (SOL) as its primary reserve asset, with a commitment to scale holdings significantly over the next 12 to 24 months.

In August, the Hong Kong branch of Standard Chartered partnered with Web3 company Animoca Brands to develop a stablecoin backed by the Hong Kong dollar. This collaboration has led to the formation of Anchorpoint Financial Limited, a joint venture designed to operate within Hong Kong’s evolving regulatory landscape.

Anchorpoint Financial formally submitted its application for a stablecoin licence to the Hong Kong Monetary Authority on 1 August. This move coincided with the launch of Hong Kong’s new stablecoin framework, following a six-month transition period.

The introduction of the new regulations brought unforeseen challenges. The rules proved to be more stringent than many market participants had anticipated, resulting in a noticeable market reaction. Shares of some Hong Kong-based companies associated with stablecoin concepts fell by up to 20 per cent in early August. Industry analysts viewed this as a necessary correction, helping to distinguish serious operators from speculative ventures.

India ranks first in cryptocurrency adoption for 2025, according to the sixth Chainalysis Global Crypto Adoption Index. The United States comes in second, indicating a rise in activity in both nations. The research shows, market trends are being influenced by institutional investment and grassroots usage. India leads in all measured categories, including retail and institutional flows. The US rise is linked to higher institutional involvement following the approval of spot bitcoin ETFs. Pakistan, Vietnam, and Brazil complete the top five.

The Chainalysis Global Crypto Adoption Index looks at the use of cryptocurrencies by people, businesses, and governments around the world. The sixth volume in the series, published in 2025, focuses on adoption trends as of right now. The index for this year shows shifts in how nations view and utilise digital assets. It covers a range of activities, from routine transactions to large-scale institutional investments, showing that cryptocurrency use is becoming more widespread.

India leads the index overall and ranks highest in retail adoption, DeFi usage, and institutional activity, a first since the index began. This reflects growth at both individual and institutional levels.

Several key factors drive India’s top ranking in global crypto adoption. The country has a large, young population that is comfortable with technology, supported by widespread access to smartphones and internet connectivity. Its rapidly growing start-up ecosystem fosters innovation, while a cultural openness to new financial tools encourages experimentation with digital assets. Together, these elements have created a strong foundation for both retail and institutional crypto activity.

Following the SEC’s approval of spot Bitcoin ETFs, financial firms became more active in the US in 2025, increasing institutional involvement. As a result of the entry of firms like Vanguard, Fidelity, and BlackRock, the United States rose to the second position in the global rankings of cryptocurrency adoption.

India, the United States, Pakistan, Vietnam, and Brazil make up the top five countries in cryptocurrency adoption. The presence of emerging markets reflects how digital assets are being used to address gaps in traditional financial systems.

Countries like Pakistan, Vietnam, and Brazil face challenges such as currency instability, limited banking access, and high remittance volumes. Cryptocurrencies offer an alternative that is faster, lower-cost, and more accessible.

On-chain transaction volume in the Asia-Pacific region reached $2.36 trillion this year, marking a 69 percent increase compared to the previous year, outpacing all other areas. India contributed significantly to this volume, supported by an active developer base and rising institutional involvement, placing it at the forefront of crypto activity in the region.

Countries such as Brazil, Argentina, and Colombia are utilising stablecoins to manage inflation and gain access to the US dollar. In Sub-Saharan Africa, cryptocurrency is being used for cross-border money transfers, offering a lower-cost alternative to traditional remittance services.

North America and Europe recorded $2.2 trillion and $2.6 trillion in on-chain transaction volume, respectively. Although APAC and LATAM are growing at a faster rate, these regions maintain the highest overall activity, driven by institutional participation and clearer regulatory frameworks. Investment from hedge funds, pension plans, and corporate treasuries continues to grow, contributing to sustained volume in both regions.

Stablecoins like USD Coin (USDC) and Tether (USDT) are essential to the global adoption of cryptocurrencies. By providing price stability tied to fiat currencies while preserving the flexibility of digital assets, they enable high monthly transaction volumes. Their extensive use indicates a need for stable value in areas with unstable currencies or restricted access to banks.

Additionally, new stablecoins like EURC and PYUSD are becoming more popular. Circle’s EURC is governed by Europe’s MiCA standards, whereas PayPal’s PYUSD has grown quickly, going from $783 million to $3.95 billion in circulation in a matter of months. These additions point to a growing stablecoin sector with more corporate participation and regulatory monitoring.

The main gateway to cryptocurrency for fiat money is still Bitcoin. More than twice as much money was invested in it as in other cryptocurrency assets, totalling $4.6 trillion between July 2024 and June 2025. With $4.2 trillion in fiat-to-crypto transactions, the US dominated the world thanks to well-established infrastructure and widespread use.

Crypto adoption is becoming less concentrated in the US, with more countries participating actively. With appropriate policies and infrastructure, India could become a leading force in the global Web3 landscape.

Thailand’s tourism sector has faced challenges in recent years due to a sharp decline in Chinese visitors and a sluggish global recovery in travel. In response, the government is launching TouristDigiPay on 18 August 2025, a programme that enables foreign tourists to convert cryptocurrency into Thai Baht for local spending. The initiative aims to revitalise tourism through alternative payment options.

The TouristDigiPay programme will be officially introduced at a press conference led by Deputy Prime Minister and Finance Minister Pichai Chunhavajira. Senior officials from the Ministry of Finance, the Securities and Exchange Commission (SEC), the Anti-Money Laundering Office (AMLO), and the Ministry of Tourism and Sports will also be present. Their involvement signals the government’s intent to implement the programme within a regulated and secure framework.

โครงการ TouristDigiPay เปิดตัวอย่างเป็นทางการแล้วครับ

TouristDigiPay จัดทำขึ้นมาเพื่ออำนวยความสะดวกและเพิ่มทางเลือกให้นักท่องเที่ยวต่างชาติสามารถแปลงสินทรัพย์ดิจิทัลที่ถือครองอยู่เป็น เงินบาท เพื่อนำไปใช้ชำระค่าสินค้าและบริการกับร้านค้าต่าง ๆ ในประเทศไทยได้อย่างสะดวกและปลอดภัย… pic.twitter.com/AeOL2QRHRp

— พิชัย ชุณหวชิร – Pichai Chunhavajira (@PichaiChun) August 18, 2025

Tourists in Thailand will be able to use cryptocurrency for local spending through a structured process. First, they convert their digital assets such as Bitcoin or USDT into Thai Baht using local cryptocurrency exchanges. The converted funds are then stored in e-money wallets, which support QR code payments, a common method across Thailand.

All transactions will be processed through platforms regulated by the Securities and Exchange Commission (SEC) and e-money providers approved by the Bank of Thailand. Tourists will not be spending cryptocurrency directly; instead, they will use Thai Baht for purchases after conversion.

Thailand is taking a cautious approach to cryptocurrency-based travel payments. The Bank of Thailand will regulate e-money providers, the Securities and Exchange Commission (SEC) will oversee bitcoin exchanges, and the Anti-Money Laundering Office (AMLO) will ensure that AML regulations are followed. Authorities will be able to oversee the TouristDigiPay programme’s deployment and manage any potential risks, as it will operate within a regulatory sandbox.

Not every traveller will have immediate access to the TouristDigiPay system. Only foreign visitors staying in Thailand temporarily will be eligible. Users must complete Know Your Customer (KYC) and Customer Due Diligence (CDD) checks to use the service. Accounts must also be opened with legally authorised e-wallet and digital asset exchange companies. These conditions are in place to prevent misuse and ensure compliance with financial regulations.

Cryptocurrency use in travel offers several practical advantages. Allowing visitors to exchange cryptocurrency for local currency eliminates the need for traditional foreign exchange, as many people already use digital assets for payments globally. Younger, tech-savvy tourists who prefer modern payment options will also find this approach appealing.

The plan presents Thailand with an opportunity to position itself as a country open to digital financial technologies and attract more foreign investment.

Tourism contributes nearly 12 percent to Thailand’s GDP, making it a vital part of the economy. As of 10 August 2025, international arrivals stood at 20.2 million, a 6.9 percent decrease from the previous year. The most significant drop came from Chinese visitors, who declined by 33 percent in the first half of the year. Thailand’s reputation has been affected by safety concerns, such as the abduction of actor Wang Xing. In response, the National Economic and Social Development Council (NESDC) has revised its 2025 foreign tourist forecast from 37 million to 33 million.

Thailand is adopting a multi-pronged strategy to revive its tourism sector. Alongside introducing crypto-based payment systems, the government is focusing on attracting travellers from the Middle East and Southeast Asia, promoting digital upgrades in tourism services, and developing policies to maintain long-term competitiveness. TouristDigiPay is one component of this broader strategy.

Thailand is not the first country to explore cryptocurrency’s potential in the travel industry. Bhutan has implemented a national cryptotourism system that accepts payments using various digital tokens via Binance Pay. Singapore has emerged as a crypto-friendly travel destination, with numerous establishments accepting digital currency.

El Salvador has adopted Bitcoin as legal tender and promotes its use through widespread adoption and the installation of Bitcoin ATMs. Thailand’s approach places it among these nations, while tailoring the system to suit its own regulatory and economic context.

If the TouristDigiPay pilot proves successful, Thailand may expand it into a nationwide system. There is also potential for collaboration with other Southeast Asian countries to develop a regional crypto tourism network. This could transform how tourists pay for services across the region.

Sponsored Article.

The crypto market is a fast-growing trading sector, already transforming both land-based and online businesses. Casinos were among the first to adopt crypto openly. But we are now standing on the brink of a technological revolution. Could blockchain reshape the way we enjoy online casinos?

Sebastian Jarosch believes so. As founder of Mithrillium Media Ltd, Jarosch brings unmatched expertise in the online casinos space. His company’s accolades—including Affiliate Programme of the Year at the 2022 SBC Awards and Best Casino Group at the 2020 CasinoMeister Awards—highlight both credibility and innovation. We spoke with him about the future of crypto in iGaming, and how affiliates must adapt to stay relevant.

Q: What does it mean for an affiliate platform to be “crypto-ready” in today’s iGaming landscape?

Cryptocurrencies like Bitcoin have become mainstream, and it is important for affiliate businesses to adapt to this. For players, it is very convenient to make deposits and withdrawals via crypto because the transactions are often instant, unlimited, free and anonymous. Many online casinos have already responded to this by integrating the most important cryptocurrencies into their cashiers. An affiliate site being crypto-ready means that the website is reviewing crypto casinos and lists them in an individual category.

Q: How are blockchain technologies changing the way casino comparison sites verify operators and rankings?

The essence of blockchain is that it is tamper-proof, decentralised, and anonymous. For review sites, this technology can be used to verify licenses, payouts, and trust certifications. Rankings and scores would be far harder to manipulate, as the verification records are public and time-stamped.

Q: Do token-based or cryptocurrency payment options influence player trust and engagement with affiliate platforms?

Crypto is very popular in iGaming, and many players use it for transactions. Players in crypto-friendly markets often view token support as a sign that a platform understands their preferences. It increases engagement by offering speed, lower fees, and sometimes exclusive bonuses. To develop trust, players want an expert opinion on reliability, licensing, and payout speed.

Q: What role does Web3 play in making affiliate operations more transparent for both users and operators?

Web3 decentralises the internet and creates a more open and honest experience. The idea is that Web3 will give customers more control over their private data and allow them to surf the internet anonymously. By making it more difficult to track their online activity, trust in online casinos can increase. Consumers would also gain more information about a site’s origins. This means affiliate websites would need to conduct extensive research to ensure that everything they say is accurate, as it can easily be fact-checked.

Q: How does Casino Groups ensure security and compliance when promoting casinos that accept cryptocurrency payments?

Security comes from testing and research. We only promote crypto casinos that are reliable, process payments in a timely manner, and are transparent about their terms and conditions. Not all casinos that deal with crypto are actually licensed, so hands-on reviews are necessary to determine if the operator is trustworthy. In terms of compliance, we follow jurisdictional advertising rules, use geo-blocking where required, and ensure all creatives meet responsible gambling standards.

Q: Are decentralised verification tools or on-chain reviews a realistic future for casino comparison sites?

On-chain reviews would provide much-needed transparency for casino reviews by making bonus data, player feedback, licenses, payout speeds, and even ownership verifiable. The challenge, however, is the adoption of such tools. This technology is complicated to set up and requires a critical mass of players and operators to participate. Until then, these tools will complement rather than replace traditional review systems.

Q: How do crypto-focused affiliates balance the appeal of faster payments and anonymity with responsible gambling principles?-

That is generally part of the review process, but with crypto casinos it is a little more complicated. It is important to ensure that crypto casinos are either licensed or have a good reputation in the industry. If a casino uses a weak license or is unlicensed, it often comes down to the operator’s work ethics to enable players to self-exclude or set deposit limits. Payout speed is one of the main reasons players choose crypto casinos, which is why we emphasise it in our reviews.

Q: Have you seen increased demand from players specifically searching for blockchain-powered or crypto-accepting casinos?

There is demand, and we have seen dedicated crypto casino affiliates pop up in various jurisdictions. Search volumes for crypto casinos and blockchain gambling platforms have steadily increased over the last 3–4 years, especially in regions with limited access to traditional payment methods. Players prefer online casinos with quick registration processes, fast payouts, and anonymity. Additionally, Crypto Casinos often offer huge welcome bonuses and are free of transaction fees.

Q: What innovations do you expect in the next 2-3 years that could redefine crypto affiliation in iGaming?

Over the next few years, crypto affiliation in iGaming is likely to be redefined by the wider adoption of stablecoins for both player deposits and affiliate payouts, reducing volatility and settlement delays. On-chain affiliate tracking will bring transparent, tamper-proof click-to-deposit attribution, while provably fair ranking algorithms will ensure comparison site scores cannot be manipulated without leaving a public record. Instant commission payments, triggered by verified player activity, will further streamline operations and build trust between affiliates and operators.

Q: Looking ahead, could crypto-readiness become a baseline expectation for all top-tier casino comparison platforms?

In the future, crypto-readiness will be normalised within the iGaming industry. Just as mobile optimisation became a standard in iGaming, crypto-readiness will be expected even from affiliates that don’t cater exclusively to crypto casinos, as it signals flexibility, modernity, and global reach. The winners will be businesses that are willing to adapt to changing trends and player preferences.

India’s cryptocurrency market has expanded rapidly, leading to increased attention from tax authorities. The Income Tax Department has issued over 44,000 notices to individuals who failed to report Virtual Digital Asset (VDA) transactions in their income tax returns. This forms part of a broader initiative to ensure compliance and bring crypto-related earnings within the tax framework.

The Central Board of Direct Taxes (CBDT) is leading efforts to identify individuals who have not disclosed profits from cryptocurrency activities. A total of 44,057 email and SMS alerts were sent to those flagged for unreported VDA transactions, according to local media outlets. In cases of continued non-compliance, the department has initiated reassessment orders, surveys, and search-and-seizure procedures under the Income Tax Act, 1961.

The NUDGE programme (Non-Intrusive Usage of Data to Guide and Enable) is an initiative by tax authorities to remind individuals to report their cryptocurrency transactions. It aims to notify potential defaulters before formal legal action is taken, allowing them to update their tax filings and avoid penalties.

India introduced a formal tax structure for VDAs in the financial year 2022–23. This includes a 30% flat tax on all crypto gains without deductions and a 1 percent Tax Deducted at Source (TDS) on each transaction, collected by exchanges or platforms. Across FY 2022–23 and FY 2023–24, taxpayers declared ₹705 crore (approximately $80.6 million) in crypto income.

Enforcement actions have revealed ₹630 crore (approximately $72 million) in unreported income linked to cryptocurrency activities. These cases involve both individual traders and crypto exchanges suspected of underreporting transaction data.

The CBDT is employing AI-based tools to monitor financial activity. Project Insight analyses discrepancies between reported income and actual spending or transaction patterns, while the Non-Filer Monitoring System (NFMS) identifies individuals likely required to file tax returns but who have not. Additionally, transaction data submitted by Virtual Asset Service Providers (VASPs) through TDS returns is cross verified with individual tax filings to detect non-compliance.

Despite widespread use of cryptocurrencies in India, strict tax regulations have raised concerns among traders. The 1% TDS on transactions and the 30% tax on gains have discouraged many retail participants. As a result, several exchanges have reported reduced trading activity, staff reductions, and, in some cases, closures.

Pakistan has proposed using surplus energy for Bitcoin mining, indicating a more flexible stance on cryptocurrency. The UAE has removed Value Added Tax on crypto transactions, making it a favourable environment for blockchain businesses.

In July 2025, BJP spokesperson Pradeep Bhandari proposed the idea of a national Bitcoin reserve. Coinbase has announced plans to re-enter the Indian market later this year, reflecting confidence in its long-term potential. Despite current regulatory challenges, India remains a significant player in the global crypto landscape. The future will depend on how effectively the government balances regulation with innovation.

As more individuals and institutions in India engage with cryptocurrency, authorities are increasing oversight to prevent tax evasion involving digital assets. This approach reflects the government’s intent to build a strong compliance framework around emerging financial technologies.

The US House of Representatives has passed the first major national cryptocurrency legislation, the Genius Act. The act, backed by the Donald Trump administration, aims to establish a clearer regulatory framework for cryptocurrencies and other digital assets. It is now headed to Trump for signature.

The Genius Act will establish a regulatory framework for stablecoins, a type of cryptocurrency pegged to “safe” assets like the US dollar. These digital tokens are used by crypto traders to move funds quickly and avoid the volatility of other coins like Bitcoin or Ethereum. The latest move marks a major milestone for the crypto industry, which has been pushing for federal legislation for years.

Trump is expected to sign the legislation on 18 July 2025. The Senate had approved the measure last month. The Genius Act is one of three pieces of crypto legislations currently advancing in the US, backed by the US president. Trump has taken a more proactive approach towards cryptocurrency as he launched a business called World Liberty Financial, saying, “I think crypto is one of those things we have to do.” This marks a turnaround from a few years ago, when he said Bitcoin seemed like a “scam” and a threat to the US dollar. It is also in stark contrast to the Biden administration, where the White House has been leading a crackdown on crypto firms in recent years.

The provisions of the act include requiring stablecoins to be backed one-for-one with US dollars or other low risk assets. Stablecoins alone have surged in popularity, helping bridge the gap between traditional finance and blockchain.

Critics argue that this bill introduces systemic risk by legitimising stablecoins without airtight consumer protections. Big tech companies could gain an unfair edge in financial markets, acting like banks without them being subject to similar oversight. Some opponents even see the bill as a backdoor endorsement of Trump-linked crypto ventures. Critics say voting for the legislation could be viewed as condoning Trump’s personal investments.

For the crypto industry, this bill is a long-awaited win. Firms now see a clearer path to innovation and consumer adoption, and many believe this could push crypto into the mainstream. Bitcoin surged past $120,000 this week, with markets reacting favourably to the regulatory clarity.

The latest move comes as Trump is reportedly working on a presidential order to allow retirement accounts to include crypto, gold, and private equity—a move that could bring trillions in investment to the sector.

The Philippines isn’t just catching up in the blockchain space—it’s sprinting ahead. Fuelled by a young, digitally native population and a hunger for innovation, the country has become a beacon of cryptocurrency adoption in Southeast Asia. While most people still think of blockchain as just Bitcoin or Ethereum, the reality here is far more diverse.

Philippine Blockchain Report 2025 was unveiled during the Philippine Blockchain Week 2025 on 10 June 2025 by Gorriceta Africa Cauton & Saavedra, Gobi-Core Philippine Fund, the Blockchain Council of the Philippines, and Tether. This report serves as a vital snapshot and roadmap, highlighting the country’s enthusiastic adoption of digital transformation.

With a median age of 26.1, the Philippines boasts a digitally fluent, mobile-first generation. This group is driving the country’s appetite for decentralised technologies, cryptocurrencies, and Web3 platforms. Unlike other countries that resist change, the Philippine government has largely welcomed blockchain.

Philippine Blockchain Report 2025 launch ceremony.

FinTech and cryptocurrency: The country ranks as the 8th highest in the 2024 Global Crypto Adoption Index, signifying a widespread embrace of digital assets. Cryptocurrency is the most recognised blockchain application among Filipinos, primarily used for trading, payments, gaming, and social media.

Gaming and NFTs: The “Play-to-Earn” (P2E) model gained immense popularity, particularly during the pandemic, with many Filipinos referring to themselves as “Metaverse Filipino Workers” (MFWs). Games like Axie Infinity provided an alternative source of income, with some players earning more than the minimum wage. Yield Guild Games (YGG), a local gaming guild, has been instrumental in this space, even raising $4.6 million in 2021 from A16z.

Beyond FinTech and gaming, blockchain is being increasingly adopted for various business applications, including identity, logistics, and enterprise solutions. Examples include FilPass for secure digital identity, BayaniChain for Blockchain-as-a-Service, and FleetHive for B2B delivery and load-sharing using blockchain.

The Bangko Sentral ng Pilipinas (BSP) guidelines for Virtual Asset Service Providers (VASPs) represent a step towards safer cryptocurrency usage. They’ve frozen new VASP applications temporarily to focus on stability and quality, not just growth. Plus, they’re experimenting with Central Bank Digital Currencies (CBDCs) through Project Agila.

The Philippines Securities and Exchange Commission (SEC) is stepping up. From advising on initial coin offerings (ICOs) to proposing rules for Digital Asset Exchanges, the commission is establishing a solid legal foundation. The Rules on Crypto-Asset Service Providers (CASPs) are a major leap forward in creating clarity and consistency.

Project Marissa (budget transparency), eGovChain (public service efficiency), and tokenised treasury bonds are just the beginning. The Cagayan Economic Zone Authority (CEZA) and the Freeport Area of Bataan (AFAB) have introduced licences for offshore blockchain businesses, aiming to position their zones as blockchain hubs.

A survey revealed that Filipinos’ involvement and awareness of blockchain technology vary significantly. While a vast majority (85 percent) have no direct connection to blockchain in their daily lives, and 70 percent are unfamiliar with the technology, a significant portion (13 percent) regularly use blockchain-based applications.

Awareness gap: According to a 2023 survey, even though the Philippines has a high percentage of cryptocurrency owners, just 46 percent of Filipinos fully comprehend cryptocurrencies, and only 28 percent are familiar with Web3. Wider acceptance is significantly hampered by this knowledge gap.

Perception of security: Among those aware, 74 percent expressed confidence in the security of blockchain. The rise of centralised exchanges like Coins.ph and PDAX has contributed to this by simplifying the user experience and providing a more structured environment.

Essential factors: Filipinos give security (74 percent), transparency (72 percent), and cost-effectiveness (66 percent) top priority when it comes to blockchain technology. This suggests that applications with solid compliance and reliable support are preferred.

Future intent: Over half (55 percent) of respondents are open to using blockchain in the future, but their intent is often conditional on further security measures being implemented.