- Roadshow to Rome

- Awards

- Exhibitors

- Speakers

- Media Partners

- News

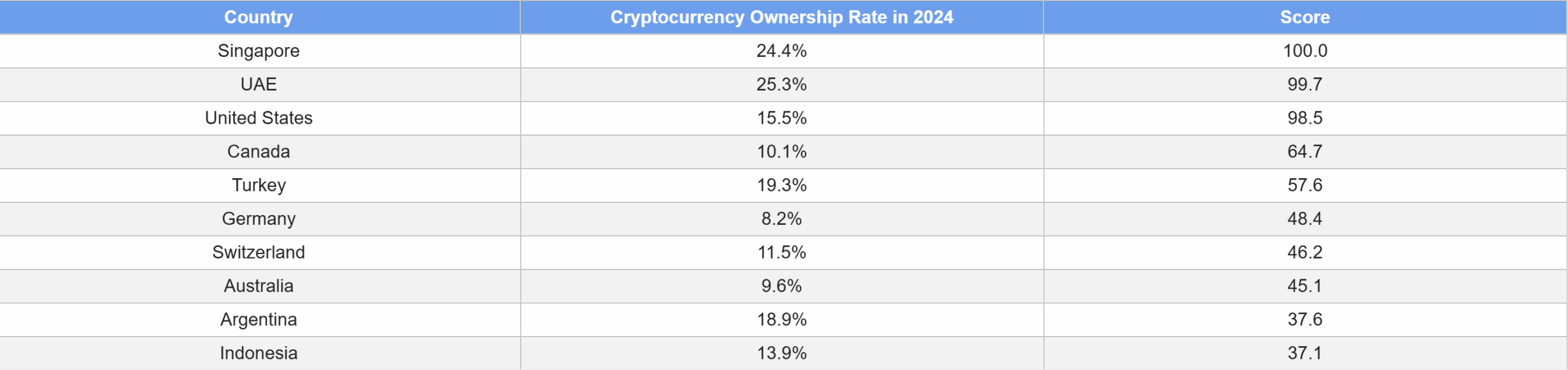

Cryptocurrency is a part of digital finance, used in transactions and institutional investments. A report by ApeX Protocol lists Singapore and the United Arab Emirates (UAE) as the leading countries in cryptocurrency activity. The data reflects adoption levels and the role of digital assets in their financial systems and societies.

With a composite score of 100, Singapore is the country with the highest adoption of cryptocurrencies worldwide, as reported by several media outlets. The percentage of residents with digital assets rose from 11 percent to 24.4 percent between 2021 and 2022. With almost 2,000 searches per 100,000 individuals, the nation also has the highest number of online searches pertaining to cryptocurrencies.

The Monetary Authority of Singapore (MAS) regulates exchanges and digital payment providers. The regulatory structure is intended to safeguard consumers while fostering innovation. The fact that cryptocurrency is utilised in a number of industries, such as retail and financial services, suggests that it is present in daily transactions.

The United Arab Emirates ranks just behind Singapore in cryptocurrency engagement, with a composite score of 99.7. Approximately 25.3 percent of the population owns digital assets, the highest recorded rate globally. Since 2019, ownership has increased by 210 percent, peaking in 2022 before stabilising.

Dubai hosts exchanges, industry events, and blockchain-related organisations. Regulatory structures such as the Virtual Assets Regulatory Authority (VARA) provide operational guidelines for businesses. The UAE offers tax arrangements, designated business zones, and policies that support blockchain-related activities.

Summary of ApeX’s report. Source ApeX

The United States ranks third globally in cryptocurrency engagement, with a composite score of 98.5, primarily due to its infrastructure. It has over 30,000 cryptocurrency ATMs, significantly more than any other country.

Since 2019, usage has increased by 220 percent, although ownership rates remain comparatively lower. Developments such as spot Bitcoin ETFs and institutional involvement have contributed to broader market participation. Retail investors have also played a role in increasing the use of cryptocurrency in financial activities.

Canada ranks fourth in global cryptocurrency engagement, with a composite score of 64.7. Since 2019, adoption has increased by 225 percent, the highest growth rate among the countries listed. There are approximately 3,500 cryptocurrency ATMs across the country, contributing to widespread access. Ownership stands at 10.1 percent, showing gradual growth compared to other leading nations.

Turkey ranks fifth in global cryptocurrency engagement, with a composite score of 57.6. Approximately 20 percent of the population owns digital assets. Online search activity related to cryptocurrency is high, with around 1,000 searches per 100,000 people. Economic factors, including currency inflation, have contributed to increased interest in digital assets.

Germany is known for having clear financial regulations, and Switzerland has banks that accept digital assets. Blockchain technology is incorporated into Australia’s digital infrastructure, and in Argentina, bitcoin adoption has increased in response to inflation. Adoption among younger users is increasing in Indonesia.

According to the ApeX Protocol study, four indicators were used to assess global trends: ownership rates, ATM availability, adoption growth since 2019, and search activity. The UAE and Turkey lead in ownership, while the United States has the most extensive ATM network. Canada recorded the highest growth in adoption, followed by the US and the UAE. Singapore ranks highest in search volume, with Turkey and Indonesia also showing significant online interest.

In contrast to the ApeX rankings, the Chainalysis Adoption Index offers a distinct perspective. For three years running, India has led the world in the adoption of cryptocurrencies, mostly because of its large retail user base. Thanks to regulatory changes and a rise in ETF activity, the US has risen to second place. With considerable development in nations like Vietnam and Pakistan, the Asia-Pacific region leads in transaction volume. Singapore stands out for its strong institutional interest and progressive regulatory environment, further solidifying its role as a regional crypto hub.